- Beyond the Balance

- Posts

- 3 Ways Sales Trick You Into Buying More

3 Ways Sales Trick You Into Buying More

How to prevent impulse purchases

Hey — it’s Lee from Refresh.me.

Labor Day sales are already beginning.

This means millions of Americans are being deceived by sale prices and spending more than they should. But not you.

In this week’s newsletter, I’m breaking down the sales tactics that trick you into spending more than you should, and how to shop smarter as a consumer.

In today’s issue:

3 ways sale prices are tricking you

Financing cars (WWYD)

How to get 24% cash back at restaurants

And in case you missed it last week, our budgeting feature is now LIVE 🥳

✅ Connect your bank accounts

✅ Categorize your transactions

✅ Track your spending and set up a budget

🔍 Deep Dive: 3 Ways Sales Are Tricking You

Let me be clear: There’s nothing wrong with purchasing something you need when it’s on sale. And sometimes, these Labor Day sales are a true jackpot.

Big-ticket items like furniture, mattresses, and appliances are often heavily discounted at this time of year. But it isn’t always the deal you think it is.

1️⃣ Fake Sale Pricing

Companies use what’s called price anchoring: The practice of displaying an inflated “original” price that makes the sale price seem like an insane deal.

Here’s an example:

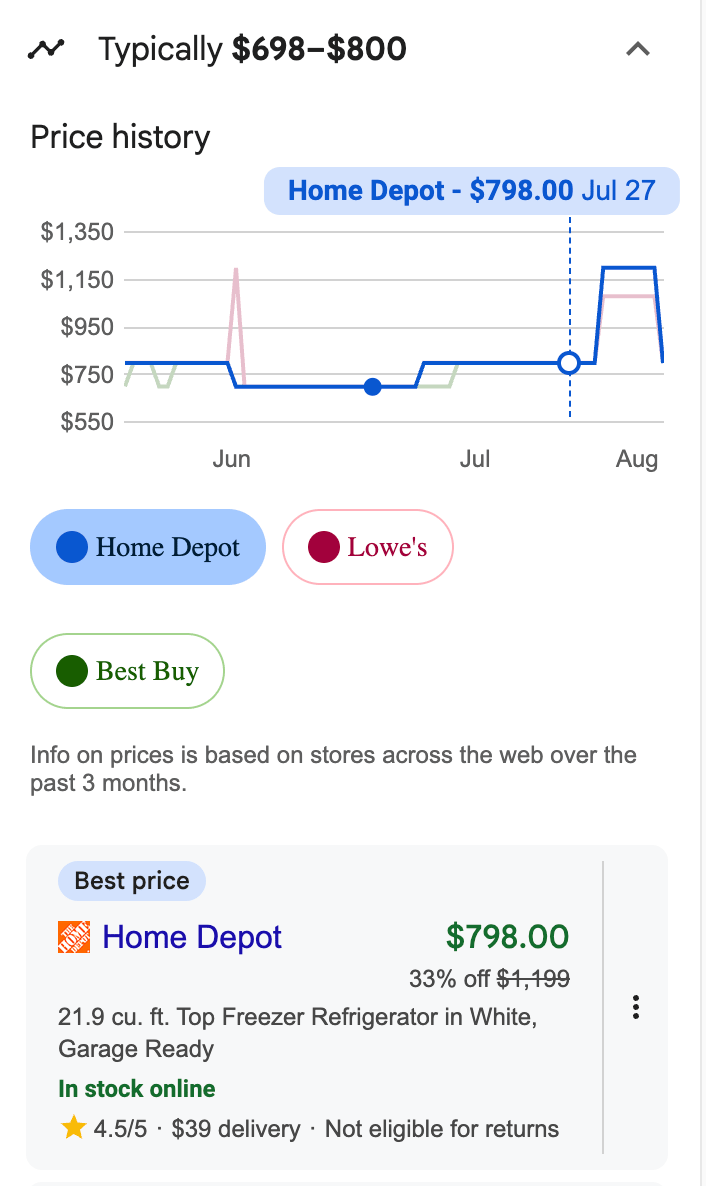

This fridge is “on sale” at Home Depot for $798, 33% off from its original price of $1,199.

This looks like a solid discount on the surface. We see a 4-digit price up against a 3-digit price and immediately think, “I must be getting a great discount.”

But if we dig a bit deeper, it’s not quite what it seems.

The fridge was $798 much of the last 2 months. It dropped to $698 for a few weeks, then increased to $1,199 for just 6 days before dropping back down to $798.

Is it still a good price? Sure. But is it an insane deal exclusive to this sale? No.

2️⃣ Urgency-Based Marketing Tactics

Labor Day sales leverage the “end of summer” atmosphere to create a sense of urgency that makes you more susceptible to spending on sales.

There’s this subconscious feeling that summer is slipping away and you need to squeeze in those final purchases. Whether it’s outdoor fear you “should have bought months ago” or home items that suddenly feel essential.

Retailers capitalize on this by positioning Labor Day sales as your “last chance” to save before fall prices kick in. This adds an artificial pressure to buy faster, throwing your rational decision-making out the window.

3️⃣ In-Store Product Placement

Retailers have entire teams of people (called visual merchandisers) whose entire role is to arrange product displays to attract customers and influence their purchasing decisions.

They study how you move through a store, what catches your eye, and how different elements of a product display impact your desire to purchase.

Here are a few things to look out for as you’re shopping in store:

1️⃣ Retailers often put staples at the back of the store. This is so you’re forced to walk past items that are often less necessary but easy to impulse purchase.

Example: Milk is usually at the back of Walmart. Clothes are right in front. When you come in to buy milk, you walk past the clothes, something catches your eye, and suddenly you’re checking out with milk and a t-shirt.

When you shop in-store during Labor Day sales, watch out for displays at the front of the store showcasing “deals.”

2️⃣ Expensive and high-margin items are often at eye level so they catch your attention more.

When those expensive items are on sale, you’re more likely to purchase them over a bottom-shelf item that’s a better price.

Example: Ever noticed the store brand items are on the bottom shelf? And the name brand items are at eye level?

3️⃣ ”Dollar deals,” or items that are just a few bucks each, make you more likely to purchase multiple.

Example: The Target dollar section is placed right when you walk in. Before you can grab what you came in to buy, you’re likely to peruse the dollar section and grab items you don’t need.

Expect to see more of this during Labor Day sales. Head down, head straight to the item you came for. 😅

Put It Into Practice

If you’re shopping this year’s Labor Day sales, use these strategies to save:

1️⃣ Make Your Wishlist Now

Make a list of what you’re in need of and what you think is a fair price. Do this before looking at any sale prices.

This prevents you from A) buying things that aren’t on your shopping list and B) being convinced something is a good price.

2️⃣ Use Pricing Trackers

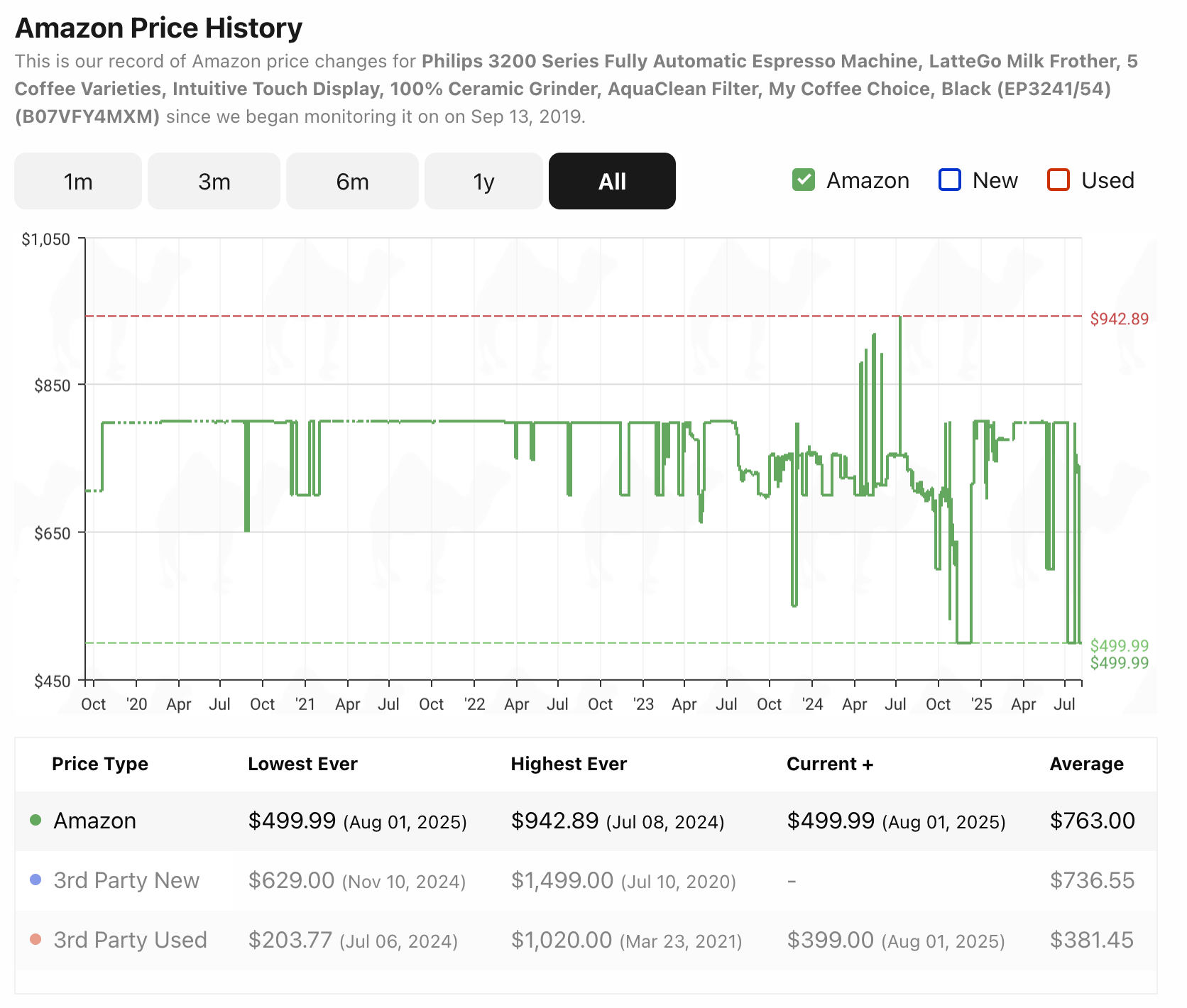

Look at the price history of an item before purchasing to truly understand whether it’s a good deal.

Here are a few I like:

CamelCamelCamel for Amazon

Google Shopping for Most Retailers

With Google Shopping, just search for the item you’re looking to purchase. Click on the item and a sidebar window will pop up with price history data.

3️⃣ Compare Prices Before Buying

One store’s “best price” is another store’s everyday price. Google Shopping allows you to look at pricing across the top 3 retailers for a product, but Price.com is another great option for price comparison.

💵 Budget Breakdown: Financing Cars

This week’s WWYD comes from a recent video from Brenda.

Here’s her story:

Took out a car loan (on a new car) for $23,000 in 2021.

Started giving her trouble 2 years in. Stopped working entirely in late 2024.

It was past warranty, and even the dealership mechanics didn’t know what was going on with it.

If she sold it, she’d only get around half the purchase price back.

To this day, Brenda owes $1,400 on the car loan despite not owning it anymore.

Now she says it would take a lot to take out a car loan again. Instead, she purchased an $1,800 used car on Facebook Marketplace and says it was a smarter choice.

Curious what team you’re on in this conversation ⤵️

What would you do? |

🔗 Quick Links

💰 Small things you can do to save money.

🍔 Get 24% cash back on local restaurants.

🏦 Tips for managing BNPL loans.

P.S. — Are you on X? If so, follow me on X/Twitter to catch my daily thoughts on personal finance and engage directly with me.

Every generation’s money trauma becomes their financial playbook:

Boomers: Post-war boom → “Work hard, save everything”

Millennials: 2008 crash → “The system is broken”

Gen Z: Everything unaffordable → “Why play by these rules?”

— Lee Schmidt (@leeschmidt123)

3:02 PM • Aug 8, 2025

What'd you think of this issue? |