- Beyond the Balance

- Posts

- 4 Things Keeping You Financially Stuck

4 Things Keeping You Financially Stuck

The psychology of financial mistakes

Hey — it’s Lee from Refresh.me.

Why do intelligent, successful people make poor financial decisions?

It’s psychological.

Our brains are wired with cognitive biases that serve us well as hunter-gatherers, but sabotage us in modern day financial environments.

Let’s take a look at some of these mental traps, and how you can avoid them.

In today’s issue:

The psychology behind your money mistakes

Should you pay off your mortgage, or invest your money?

The government is funding child savings accounts

🔍 Deep Dive: The Psychology Behind Your Money Mistakes

Today we’re taking a look at the most common mental traps that lead people to making financial mistakes, and practical steps you can take to avoid them.

1️⃣ Loss Aversion: Why You Cling to Bad Investments

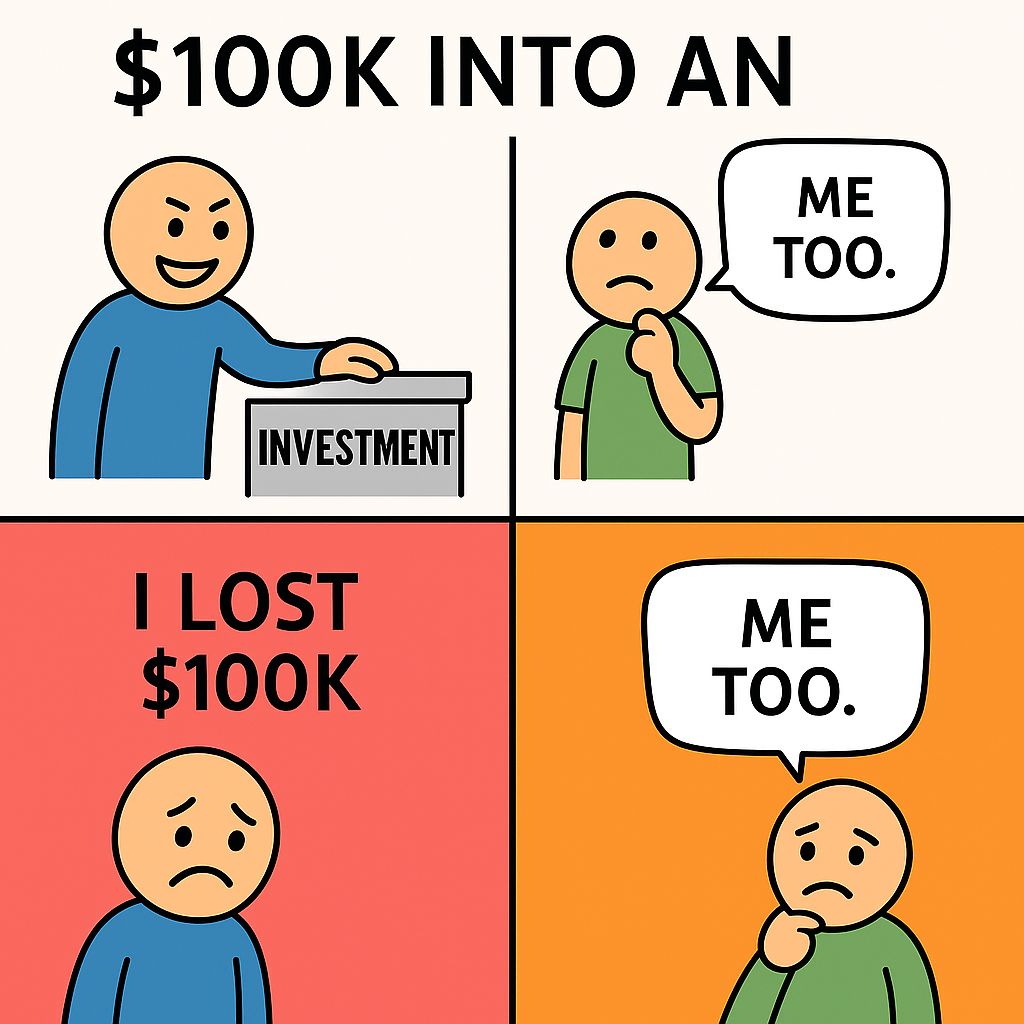

The Psychology: Loss aversion is our tendency to feel the pain of losing something twice as strongly as the pleasure of gaining the same thing.

How it Hurts Your Finances: Loss aversion explains why many people hold onto losing stocks too long (hoping to recover losses) and sell winning stocks too early (before they’ve locked in gains).

It's also why you might spend 10 minutes moving your car to avoid getting a $20 parking ticket, but not spend the same 10 minutes negotiating to save the same $20 on your recurring $200 cable bill.

Because again—we perceive the penalty of $20 from receiving a parking ticket as more significant than a potential savings of $20 on a larger, ongoing expense.

This mental bias can cause you to stick with poor financial choices, even when it no longer makes rational sense.

The Solution: Know what’s important to you before making financial decisions. For example, decide in advance what your personal threshold is for selling an investment.

When emotions are high and you’re feeling a loss, take a minute to slow down and remind yourself of this before making any big decisions.

2️⃣ Present Bias: The Enemy of Future Wealth

The Psychology: Present bias is our tendency to give stronger weight to immediate rewards relative to later rewards.

Brain imaging studies actually show that thinking about immediate rewards activates the emotional center of the brain, while thinking about future rewards activates the rational center.

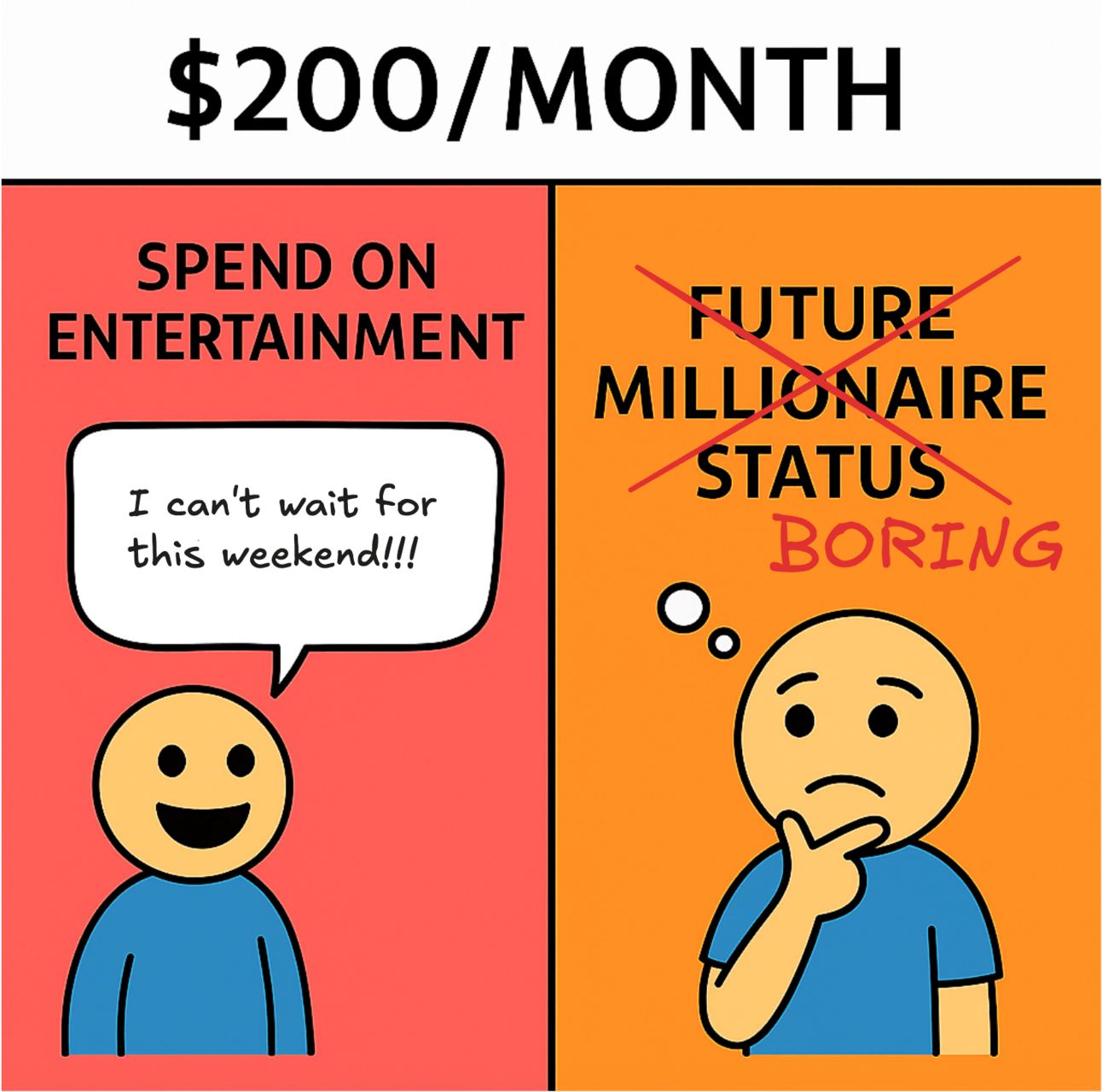

How it Hurts Your Finances: A 25-year-old choosing between investing $200 per month for retirement, or spending it on entertainment, will often choose the latter.

Not because they’re financially irresponsible or lack discipline, but because the immediate fun feels tangible. The future millionaire status feels hypothetical.

The present reward feels greater because it’s more difficult to rationalize future rewards.

The Solution: Set up automatic financial actions that prioritize your long-term goals. For example, schedule automated deposits into savings and investment accounts immediately after payday. This way future wealth building happens effortlessly without relying on willpower.

You can also make your long-term goals feel more tangible by clearly visualizing or tracking your progress, like seeing your savings grow in real-time.

3️⃣ Social Proof: Following the Financial Herd

The Psychology: Social proof describes our tendency to follow others’ behaviors when we’re uncertain about the right action.

Because…if a bunch of other people are doing it, it must be the right thing to do?

How it Hurts Your Finances: Social proof drives lifestyle inflation, investment bubbles, and “keeping up with the Joneses”.

Not everyone you see makes the best financial decisions, so you have to be careful about how you view the financial lifestyles and individuals you see normalized in the world.

The Solution: Actively question whether financial decisions are driven by your goals or others’ actions. This is especially true with modern social media, where it’s easy to convince yourself that luxury lifestyles are the norm.

Before making a major purchase, ask yourself: “Would I want this if nobody knew I had it?” This can help distinguish between genuine desire and social pressure.

4️⃣ Anchoring Bias: The First Number That Sticks

The Psychology: Anchoring bias, first identified by Kahneman and Tversky, shows that people heavily rely on the first piece of information they receive when making decisions.

This becomes an “anchor” for future financial decisions.

A classic example: An employer will almost always offer you a low salary as the starting point of a negotiation so that when you respond, you’re more likely to offer a counter figure that is close to that initial offer. And landing anywhere north of the initial offer feels like a “win” even if it wasn’t.

Another example: You see a TV on sale with a “retail” price of $800, but it’s on sale for $300. And because $800 is the first piece of information you see, $300 seems like a steal.

How it Hurts Your Finances: Anchoring explains why many people accept the first offer given in a salary negotiation, or very close to it—when in reality it’s possible they could have gotten much more.

This is also why real estate agents show you an expensive house first (all houses after that appear “cheap”), and why retailers use “Was $199, Now $99” pricing.

The Solution: Research market rates and prices before negotiations and large purchases. Set your own anchor by thinking about your desired number first.

For example: Before looking at the TV, ask yourself: “What price would make this a steal to me? What is my budget for this?”

👉 Put It Into Practice

1️⃣ Think about which of these biases most affects your own financial decisions.

2️⃣ Choose one counterstrategy from today and implement it.

For example, if you struggle with present bias, set up a new automatic transfer to savings. Or if anchor price tactics lead you to making impulse purchases, practice setting your own anchor price.

💵 Budget Breakdown: Pay Off Your Mortgage or Invest Your Money?

Here’s an interesting scenario from Dave, a single 57-year-old.

Here’s how Dave makes his income:

He has one rental in a stable, but pricey market

He owns a consulting business

He earns a salary as a professor at a public university

He has the following loans:

Primary Home | $1.5M value | 2.87% rate | Owes $459k on the mortgage |

|---|---|---|---|

Condo | $400k value | 7.4% rate | Owes $169k on the mortgage |

He also has:

$462k in tax-deferred investment accounts

$420k in taxable accounts

No other debts

Here’s his dilemma:

He’s receiving a $375k payment at the end of the year.

He’ll be able to keep around $248k of this.

Dave’s financial advisor suggested putting most of the funds into a mix of ETFs, mutual funds, and money market accounts. He also suggested keeping the condo loan, but Dave isn’t convinced.

Dave is debating purchasing another rental unit for $400k or paying off the $169k mortgage he has on the condo he already owns.

My first question: Where is this $375k coming from? And where can I get a piece of this? 👀

In all seriousness, here’s what I’d think about if I were Dave:

What are his long-term financial goals? Is it to generate more cash flow from rental properties and retire? Or is it to live off dividends?

The mortgage rate of 7.4% is pretty high. Is the amount he’s saving on mortgage interest more or less than if he invested these funds?

If he invests into liquid investments (things that allow him to pull out the funds and change course when needed), that isn’t a bad idea.

And in most cases, here’s what I’d suggest for someone like Dave:

First pay off the high-interest mortgage first. At 7.4%, this condo loan is costing Dave significantly more than he’s likely to reliably earn from investing elsewhere. Clearing this debt instantly improves monthly cash flow and provides guaranteed returns.

With the remaining funds, invest in a diversified mix of ETFs or mutual funds, especially if flexibility and liquidity are important.

As a general rule: Always eliminate high-interest debts first, then use leftover cash to build your investments.

Let me know your thoughts below!

What would you do? |

🔗 Quick Links

💰 The government is funding kids’ savings accounts.

🏦 Here are the best HYSAs in June 2025.

🌯 Why people are renting their food to “save money.”

P.S. — Are you on X? If so, follow me on X/Twitter to catch my daily thoughts on personal finance and engage directly with me.

College degrees are expensive participation trophies.

Why are kids in class just for a professor to read straight out of a $50 textbook from Amazon?

Employers care less about credentials and more about skills anyways. Yet 18-year-olds are still signing up for $150k of debt

— Lee Schmidt (@leeschmidt123)

2:58 PM • Jun 13, 2025

What'd you think of this issue? |