- Beyond the Balance

- Posts

- 5 Ways to Make Money This Week

5 Ways to Make Money This Week

Practical ways to earn and save

Hey — it’s Lee from Refresh.me.

Most financial advice focuses on long term strategies to build wealth: investing for decades, building wealth slowly, compounding value over time.

And that’s the way to build real wealth. But sometimes you just need a quick win to stack some 💵💵💵.

Today I’m giving you 5 quick ways to get a little extra cash into your bank account ASAP (nothing weird or scammy 🙅🏼♂️).

In today’s issue:

5 ways to increase your bank balance this week

Budget Breakdown: Paying off credit card debt with personal loans

How an average girl made $142k from her side hustle

🔍 Deep Dive: 5 Quick Ways to Get Some Extra Cash in Your Bank Account

#1: Negotiate a Monthly Bill 📅

💵 Potential Savings: $20-$100 per month

This is the fastest way to get some funds back is to keep the money from leaving your account in the first place. And the results often surprise people.

Best Targets for Quick Wins

🚗 Car Insurance: Take 10 minutes to get new quotes on car insurance from competitors. Then call your insurance provider and tell them you’re thinking about switching because you found a better rate somewhere else. Ask them to match that cheaper rate. This will save you an average of $30 - $80 per month.

🛜 Internet: Similar to car insurance, get quotes from a competitor in your area. Call up your current provider, and threaten to cancel since you found a lower price from their competitor. Then you’ll get transferred to the retention department, where you’ll likely be offered a discount to stay with them. This will save you an average of $20 - $60 per month.

📱 Phone Service: Are you starting to see a pattern here? Call up a competing phone carrier and get pricing for a similar phone plan. Phone carriers like Verizon and AT&T will do almost anything to keep you with them since it’s extremely expensive for them to acquire new customers. This will save you an average of $15 - $40 per month.

💳 Credit Card Annual Fees: Call up your bank and request a waiver on the annual fee. If they decline, tell them you’d prefer to downgrade your card to a no-annual fee card. It’s not as foolproof as car insurance, internet, and phone, but you can typically get this waived or reduced. This will save you an average of $95 - $100 per year.

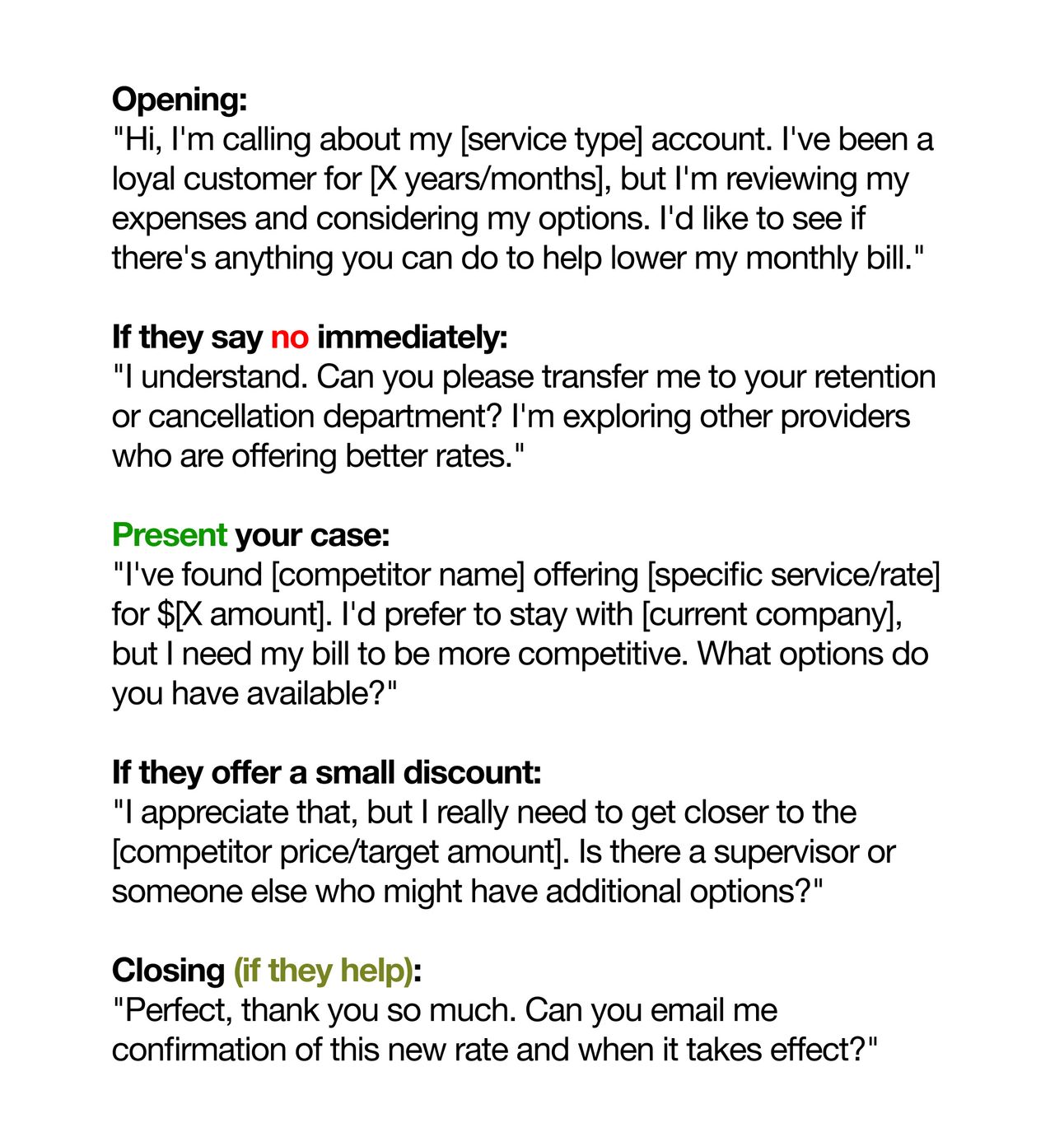

Sample Call Script

When you call these companies up, you can use this general script while you’re on the phone:

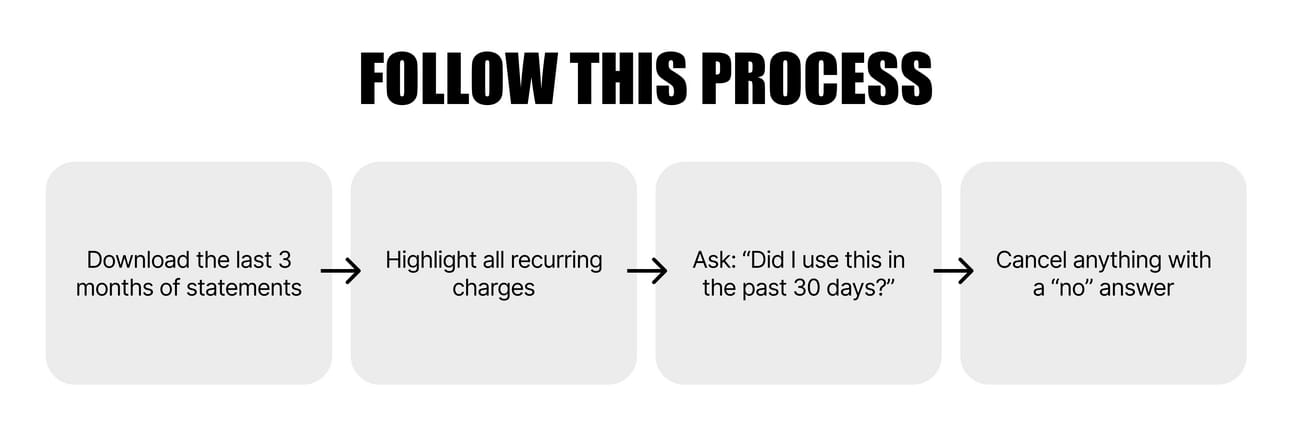

#2: Cancel Forgotten Subscriptions 🔄

💵 Potential Savings: $50-$300 per month

Americans have an average of 3.3 subscriptions they don’t use. If each one was around $30, that’d amount to $1,080 in wasted cash per year!

Finding these and canceling them is almost free money.

👀 Where to Look:

Bank and credit card statements for the last 3 months

App Store and Google Play Store purchase history

Email receipts for recurring charges

🤔 Common Forgotten Subscriptions:

Streaming services you signed up for to watch one show

Gym memberships you don’t use

App subscriptions for productivity tools you tried once

Magazine or news subscriptions from free trials

Cloud storage you’ve outgrown

Software subscriptions for old projects

#3: Sell Items You Don’t Use 📺

💵 Potential income: $100-$1,000+

You probably own hundreds of dollars worth of things you’ve accumulated that you don’t use anymore. Converting these into cash takes minimal effort but can generate some significant cash.

High Value Items to Sell:

Electronics (old phones, TVs, gaming consoles, tablets)

Designer clothing and accessories (sell on Curtsy, Poshmark, and Depop)

Fitness equipment you don’t use

Books (especially textbooks)

Tools and equipment (anything in your garage you don’t use?)

Collectibles and hobby items

👉 Quick Tip: List things on Facebook Marketplace and price them 10-15% below market value for faster sales. If your goal is quick cash flow, don’t get hung up on maximizing your profit.

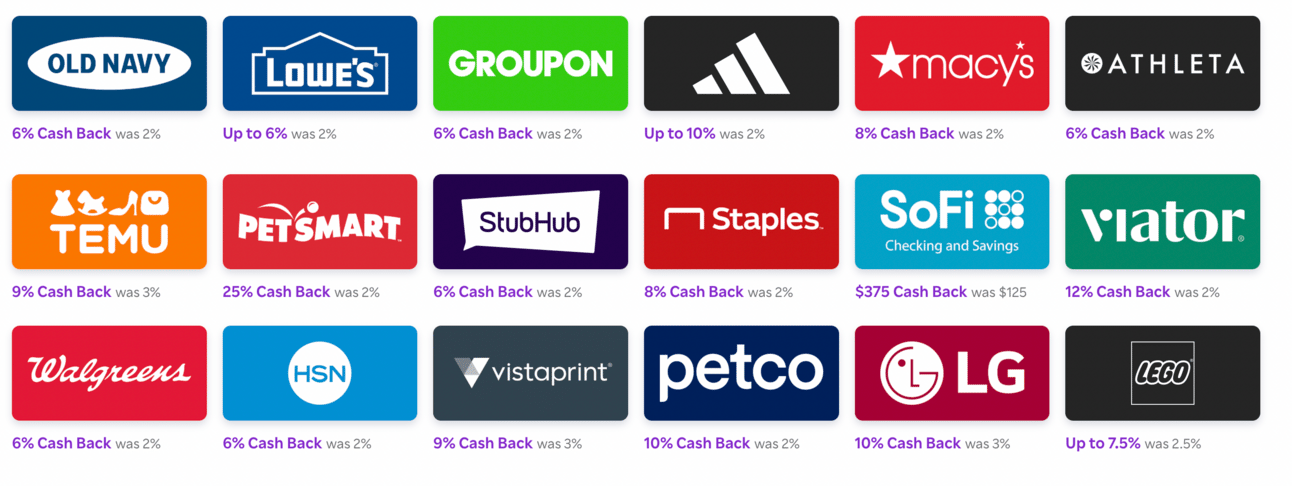

#4: Use Cash Back Apps 💸

💵 Potential income: $10-20 per month

Cash back apps aren’t going to make you rich. But depending on your shopping habits, your earnings can add up pretty quick.

Top Cash Back Apps to Check Out:

#5: Switch to a High-Yield Savings Account 📈

💵 Potential income: depends how much you have saved

If your money is sitting in a traditional savings account earning 0.01% interest, you’re losing money due to inflation.

A high-yield savings account is the same as a traditional savings account, except you earn interest on the money that sits in your account. Most HYSAs have zero fees, making it a no-brainer to switch.

Here are some of the current HYSA rates:

SoFi: Up to 3.80% APY

Synchrony Bank: 3.80% APY

Axos One: Up to 4.66% APY (with min. balance of $1.5k)

👍 It’s simple to switch:

Open a new HYSA online (10 minutes)

Transfer funds electronically (1-3 days)

Update any automatic transfers (15 minutes)

Here’s a calculator to estimate how much switching to an HYSA could earn you ⤵️

Put It Into Practice

This week, take these 5 actions:

1️⃣ Negotiate one bill

2️⃣ Cancel a subscription

3️⃣ Sell at least one item

4️⃣ Download a cash back app

5️⃣ Open a HYSA

💵 Budget Breakdown: Using Personal Loans to Pay Off Credit Card Debt

This is Jocelyn from TikTok. She shared her…”unique” approach to paying off credit card debt: consolidating into personal loans 🤨.

Here’s her story:

💳 She consolidated credit card debt from 4 cards into 3 personal loans.

👎 Initially, this didn’t work for her. With her first personal loan, she paid off the credit card debt then went right back to using the cards.

🛍️ After learning to manage her impulsive shopping (driven by undiagnosed ADHD), she tried borrowing a personal loan again.

😃 Now she’s on track to paying off her credit card debt, spending better, and even says it improved her credit score (low 600s → 800+).

The big question: Is it a good idea to borrow a personal loan to pay off credit card debt?

Quick answer: maybe, but probably not.

Personal loans typically have lower interest rates than credit cards. By consolidating your credit card debt to a personal loan, you could save on interest and pay off your debt faster.

However there’s one caveat—and this is a big caveat. As Jocelyn said, borrowing a personal loan won’t address the underlying issue that got you into debt in the first place. You could borrow a personal loan, pay off your debt, then wind up right back in debt if you aren’t careful.

You need to be extremely careful if you decide to go this route. It’s a risk. If you’re not 100% confident in your ability to pay back the personal loan and not use the credit cards irresponsibly again, I’d stay away from this approach.

What would you do? |

🔗 Quick Links

😱 Ex-spouses are living together to save money.

🤑 How this girl made $142k from her side hustle.

👨⚖️ How a new bill impacts student loan repayment options.

P.S. — Are you on X? If so, follow me on X/Twitter to catch my daily thoughts on personal finance and engage directly with me.

After the first day of Prime Day...

Who didn't buy anything and invested it instead?

— Lee Schmidt (@leeschmidt123)

4:20 PM • Jul 9, 2025

What'd you think of this issue? |