- Beyond the Balance

- Posts

- Extra Debt Payments Don’t Always Make Sense

Extra Debt Payments Don’t Always Make Sense

Whether extra payments make sense for you

Hey — it’s Lee from Refresh.me.

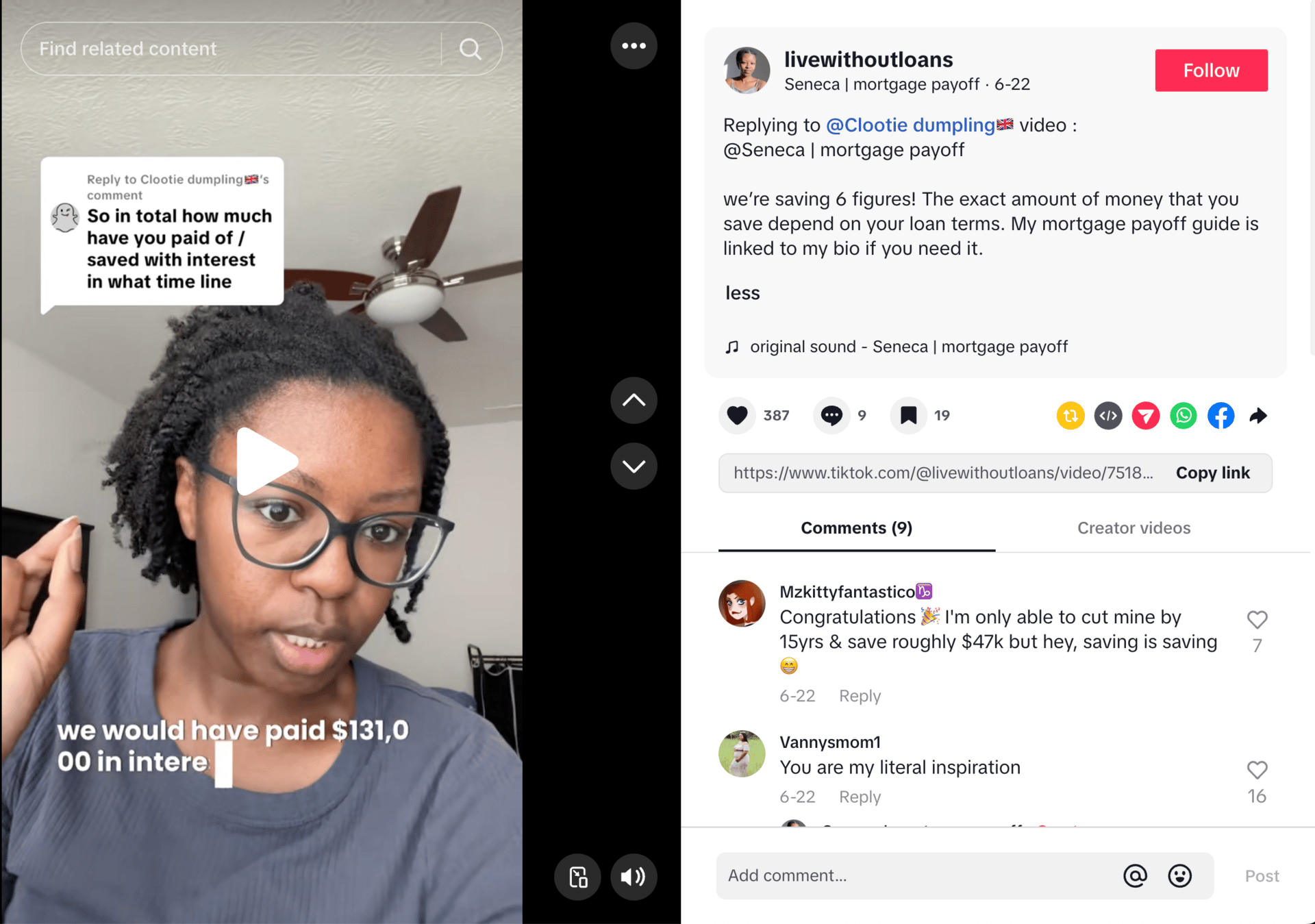

I’ve been following this creator’s journey to paying off her $254k mortgage as fast as possible.

She and her husband purchased the home in 2020 and are set to make their last payment this week.

She has a 3-4% interest rate (standard for 2020 mortgages) and a 30-year loan term.

For them, making aggressive surplus payments saved $131,000 in interest compared to making the minimum payment.

This got me thinking: When does an aggressive surplus payment approach make sense? And when does the opportunity cost outweigh the interest savings?

In today’s issue:

Do surplus payments make sense for you?

Budget Breakdown: Paying off a mortgage early

Do you actually save money on Prime Day?

🔍 Deep Dive: When Surplus Loan Payments Make Sense

Opinions on social media seem to be split whenever someone announces that they’ve paid off a chunk of debt:

50% of people celebrate the achievement

50% of people question whether it made financial sense

Both sides have valid points.

It’s a fundamental debate between mathematical optimization and the psychological satisfaction of eliminating debt.

Sometimes the “right” financial decision depends on more than just interest rates and opportunity cost.

Here’s how to know which decision is right for you. Let’s get into it ⤵️

The Mathematical Optimization Side

There’s some basic math that can help guide these decisions.

A simple rule: If you can reliably earn more from investing a hypothetical additional payment than you’re paying in debt interest, then investing is the smarter mathematical choice.

Example:

4% mortgage interest vs. 8% average stock market returns = invest the money

22% credit card interest vs. 8% market returns = pay off the debt aggressively

The issue: Investment returns aren’t guaranteed, debt payments are certain, and we aren’t perfectly rational beings. There’s an emotional side to this too.

If we break this down by debt type, here’s the general rule of thumb:

Consumer Debt: Almost Always Pay Off Aggressively

Credit cards, personal loans, and payday loans all have high interest rates at 15-25%. There are no tax benefits to holding this debt, no collateral backing the debt, and they’re often indicators of spending problems.

Here’s why aggressive surplus payments makes sense ⤵️

The Math | $10,000 credit card debt at 22% interest costs $2,200 annually. |

The Psychology | Consumer debt often creates stress and limits your budget. |

Exceptions | If you have a 0% promotional rate and the discipline to invest the difference WHILE making payments, this can work. |

Mortgages: What Feels Good to You

The decision whether to pay a mortgage off early is complicated because of the loan size, duration, and tax implications.

The Case for Early Payoff:

Could save you a significant amount in interest

Lowers monthly expenses, providing peace if you face job loss or income reduction

Lowers monthly obligations in retirement (if you plan to hold until then)

No longer dependent on market fluctuations for refinancing

The Case Against Early Payoff:

Mortgage rates are often low (3-7%), meaning investments could return more

Interest on the home loan could be tax-deductible

If you make extra payments, you’ll have less cash liquid for other opportunities.

Inflation makes future payments “cheaper” over time.

💡 Some questions to ask yourself here:

Does debt freedom align with your goals?

Are the psychological benefits of paying off the loan worth the opportunity cost to you?

What is your loan size and interest rate?

Here’s a great calculator to help you run the numbers on this ⤵️

Student Loans: Depends on the Loan

Student loan payoff decisions depend heavily on interest rates and loan terms.

Federal Student Loans | Private Student Loans |

|---|---|

Often have low interest rates (3-6%) | Higher rates (5-12%+) |

Interest may be tax deductible | Interest may be tax deductible |

Offer income-driven repayment and forgiveness programs | No federal protections or forgiveness options |

Generally favor minimum payments with extra money invested. | Often worth paying off aggressively, especially above 7% rates. |

Car Loans: Usually Pay Off Early

Car loans typically warrant aggressive payoff because:

The asset depreciates rapidly

Interest rates often exceed 4-8%

No tax benefits

Psychological relief of owning the car outright

The exception: If you have a very low promotional rate (0-2%) where investing the difference makes mathematical sense.

Now, The Emotional Side

Math isn’t everything. Personal finance is personal, and the emotional aspects of debt often matter more than pure math.

Psychological Benefits of Early Payoff:

Reduced financial stress and anxiety

Greater sense of control and security

Simpler financial life with fewer monthly obligations

Momentum and satisfaction by paying off debt

Emotions Should Override Math If…

Debt payments prevent you from sleeping well. You’re constantly thinking about your debt.

You’re risk-averse and prefer guaranteed returns.

You’re nearing retirement and want reduced obligations.

The debt represents past financial mistakes you want to correct.

Put It Into Practice

If you have debt and you’re debating whether to make extra payments, follow this framework this week:

1️⃣ Step 1: Look at the Interest Rates

Above 7%: Usually pay off aggressively

4-7%: Depends on other factors

Below 4%: Usually invest instead

2️⃣ Step 2: Tax Considerations

Is the interest tax-deductible?

What’s your effective interest rate after taxes?

3️⃣ Step 3: Risk Assessment

How stable is your income?

Do you have adequate emergency funds?

What’s your risk tolerance for investments?

4️⃣ Step 4: Opportunity Cost

What else could you do with the money?

5️⃣ Step 5: Personal Values

How much does debt stress affect you?

Do you prefer certainty or growth potential?

💵 Budget Breakdown: Paying Off a Mortgage Early

I’m curious how you’d handle Seneca’s situation:

$254k mortgage borrowed in 2020

3-4% interest rate (based on her mentioning $131,000 in interest if minimum payments were made over 30 years)

Seneca and her husband chose the path of making extra payments. They saved $131,000 in interest and 25 years on their mortgage loan.

Based on some backend estimates, I’m guessing she’s putting around $5,000 per month onto her mortgage, which is around $4,000 more than the minimum.

If Seneca and her husband had invested the $4,000 per month for 5 years, assuming a 6% return rate, she’d have $277,943 after 5 years. $38,000 of that would be interest earned.

If she let that sit for another 25 years without contributing another dollar, she could have $1.1M.

What would you do? |

🔗 Quick Links

👀 This 24-year-old plans to retire by 40, and here’s her plan.

🛍️ Do you actually save money on Prime Day? Here’s what retail analysts say.

💰 Frugal people share their best money-saving tips.

P.S. — Are you on X? If so, follow me on X/Twitter to catch my daily thoughts on personal finance and engage directly with me.

After the first day of Prime Day...

Who didn't buy anything and invested it instead?

— Lee Schmidt (@leeschmidt123)

4:20 PM • Jul 9, 2025

What'd you think of this issue? |