- Beyond the Balance

- Posts

- How to Build Real Wealth

How to Build Real Wealth

It’s not what you think

Hey — it’s Lee from Refresh.me.

Most people think wealth is about having millions in the bank or driving expensive cars. But this couldn’t be further from the truth.

Real wealth is invisible.

Wealth is in:

Money you don’t spend

Choices you’re able to make

Control you maintain over your time and decisions

In today’s issue:

How to build real wealth

Moving to save money (WWYD)

New app to earn rewards

🔍 Deep Dive: Real Wealth is What You Don’t See

Morgan Housel’s Psychology of Money discusses this idea of what real wealth looks like.

The gist of what he says is: What we desire isn’t the Porsche or 6-bedroom house, it’s the feeling those items provide.

It’s the ability to buy whatever vehicle you want, not just the one you can afford. Or the decision to live in a home that feels luxurious and inviting.

I was reminded of the book this week and wanted to share some of the most important learnings from it.

1️⃣ Real Wealth is What You Don’t See

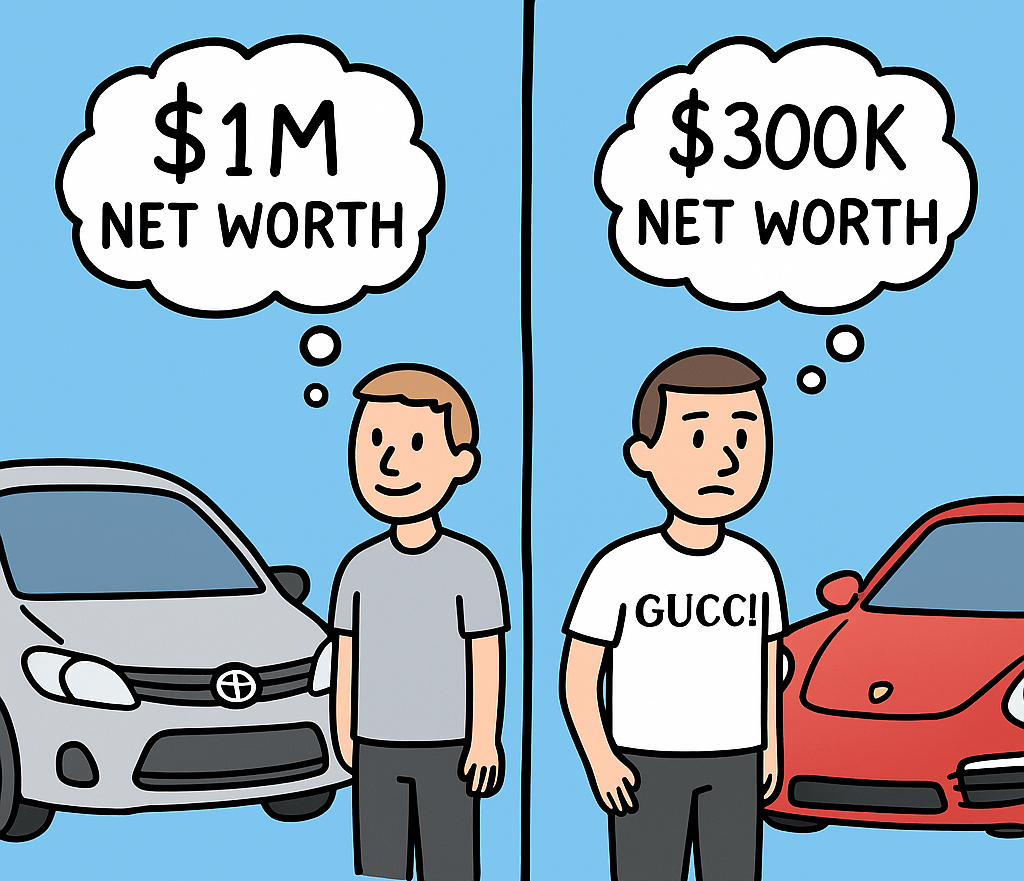

When someone has money but doesn’t spend it on visible things, you can’t tell they’re wealthy. But that doesn’t mean the person driving a Porsche out of the driveway at their 6-bedroom house is wealthy.

Why This Matters: We often confuse wealth with income or possessions. A person driving a $100,000 car might be broke, and the person driving an old Toyota might have $500,000 invested.

Take Action: What’s one “wealth signal” you’re paying for? Think: expensive car payment, luxury apartment, designer clothes. Where can you cut back on that expense?

2️⃣ Control Over Your Time is the Ultimate Luxury

The highest form of wealth is the ability to wake up every morning and say, “I can do whatever I want today.” — Morgan Housel

Control over your time matters more than any material possession.

Why This Matters: Spending on things that give you more control over your time might make you happier than those that don’t.

For example, instead of spending on a dinner out, you spend $100 to have someone clean your home. You save 4 hours cleaning and can use the time to do whatever you want.

Take Action: Make sure your budget allows you to spend in areas that give you more control over your time. If it doesn’t, update it.

3️⃣ Your Personal Inflation Rate Matters More Than the Market

It doesn’t matter if your money grows in the stock market or the value of your home skyrockets. If your lifestyle inflation rate is high, you won’t build wealth.

Why This Matters: Most people increase their spending as their income increases. This eliminates the wealth-building benefit of earning more.

A promotion from $60k to $70k should increase your savings rate, not how much you spend on frivolous things.

Take Action: Reflect on how much your income has grown over the last 3 years. Has your spending increased at the same rate? Or have you saved and invested the difference?

4️⃣ Room for Error Prevents Financial Ruin

The best way to build wealth is to assume things will go wrong and prepare.

Make decisions that give you a safety net:

Emergency fund

Conservative debt amounts

Diversified income

This can help protect you from life’s inevitable surprises.

Why This Matters: If your financial plan banks on everything going well, it’ll fail. Job losses, health issues, market crashes, and family emergencies are bound to happen.

Wealthy people build buffers that let them survive unexpected events without spiraling into financial ruin.

Take Action: Look at your safety nets. Do you have an emergency fund? Do you have debt that could be an issue if your income dropped? Do you have multiple sources of income?

Put It Into Practice

Focus on the 4 action steps above this week:

Cut back spending on wealth signals.

See if your budget can allow you to spend more on things that give you time back.

Check your spending history for signs of lifestyle inflation.

Create safety nets for life’s unexpected moments.

💵 Budget Breakdown: Moving to Save Money

This family moved from California to Tennessee to save money. Now they’re having regrets and debating moving back to the West Coast.

Here’s the TLDR:

They liked CA but moved to TN to save money and slow down.

Homes in TN were about the same price in desirable areas.

They moved 20 miles outside the city to save money. They miss having things to do nearby.

Traffic is still a major issue in their rural community. Gas is around $1 cheaper per gallon, but they’re spending just as much on gas because of how much time they spend in the car.

This (plus the husband taking a pay cut in TN) has them exploring a move back West.

What would you do? |

🔗 Quick Links

P.S. — Are you on X? If so, follow me on X/Twitter to catch my daily thoughts on personal finance and engage directly with me.

Every generation’s money trauma becomes their financial playbook:

Boomers: Post-war boom → “Work hard, save everything”

Millennials: 2008 crash → “The system is broken”

Gen Z: Everything unaffordable → “Why play by these rules?”

— Lee Schmidt (@leeschmidt123)

3:02 PM • Aug 8, 2025

What'd you think of this issue? |