- Beyond the Balance

- Posts

- How to Save Thousands of Dollars Per Year

How to Save Thousands of Dollars Per Year

Learn how to negotiate lower rates on subscriptions and services

Hey — it’s Lee from Refresh.me.

When was the last time you negotiated a lower bill?

If you’re like most people, the answer is probably “never.”

Here’s the thing: Companies like service providers and subscription services are often willing to reduce your bill significantly. You just have to ask.

In today’s issue:

How to negotiate bills and save money

Splitting your bills with your partner

Avoiding a common financial mistake everyone makes

🔍 Deep Dive: Companies Are More Willing to Negotiate Than You Think

Whenever I talk to people about negotiation, I hear the same thing: But why would they offer me a lower rate?

Because they view you through the lens of Lifetime Value (LTV).

This is the total amount of money they expect to make from you, as a customer, over the course of your entire relationship with them.

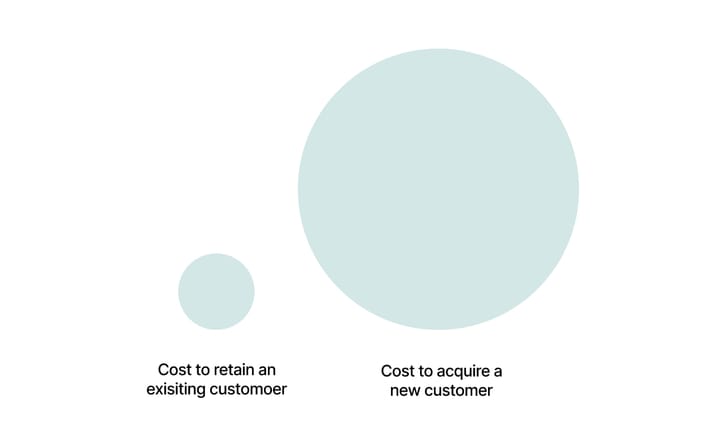

If they lose your business, they’ll need to acquire a new customer to replace you…and customer acquisition is expensive.

Like 5-25x more expensive than retaining an existing customer.

Beyond just acquisition costs, studies have shown increasing customer retention by just 5% increases profits by 25-95%.

The point: This creates a powerful dynamic in your favor. It’s almost always cheaper for a company to offer you a discount than to lose you and find a replacement customer.

🧾 Which Bills to Negotiate

You can’t negotiate every bill, but there are a few specific types worth focusing your efforts on:

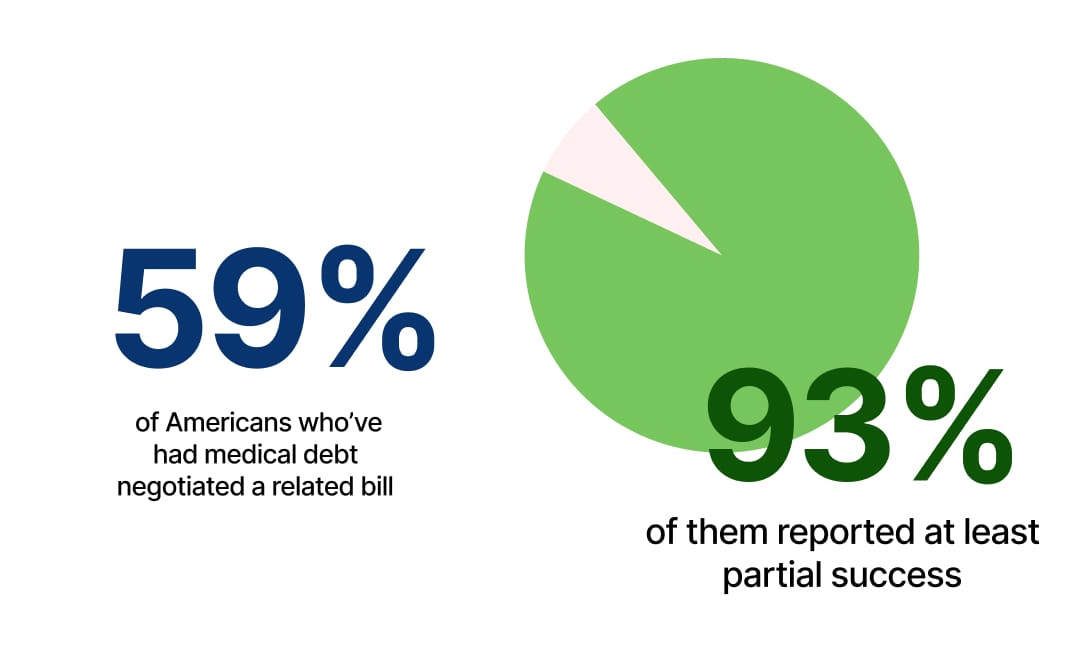

🩺 Medical Bills (93% success rate)

Medical billing is notoriously complex, and providers often prefer a guaranteed payment versus a lengthy collection process.

According to a LendingTree study, 59% of Americans who’ve had medical debt negotiated a related bill—and 93% of them reported at least partial success.

At the very least, always ask for an itemized receipt. Around 80% of medical bills have errors, and you could be paying more than you need to.

📅 Subscription Services (90% success rate)

While there isn’t specific data on negotiating subscriptions like Netflix, there’s an average success rate of 90% for recurring subscriptions.

This includes expenses like:

Gym memberships

TV subscriptions

Amazon Prime

Music streaming services

Clothing rental subscriptions

Home security/alarm system subscriptions

Even without a formal negotiation, here’s what you can do:

Visit the website for your chosen subscription service.

Go through the cancellation flow.

You’ll probably get a discount offer before your fully cancel.

💳 Credit Card Fees and Interest (89% success rate)

Credit card fees and interest are two of the most under-negotiated costs—yet they have some of the highest success rates.

What They Negotiated | What They Got |

|---|---|

Annual fee | 72% had it waived 18% had it reduced |

Late fee | 89% had the late fee waived |

Interest rate | 76% got a lower interest rate Average of 6.5 point reduction. |

Data via LendingTree.

📱 Phone and Cable Services (64% success rate)

Telecom companies have some of the highest customer acquisition costs—$315 per subscriber on average.

If you attempt to switch services, they’ll fight hard to keep you.

One study found that 64% of mobile customers who negotiated for a better deal got one.

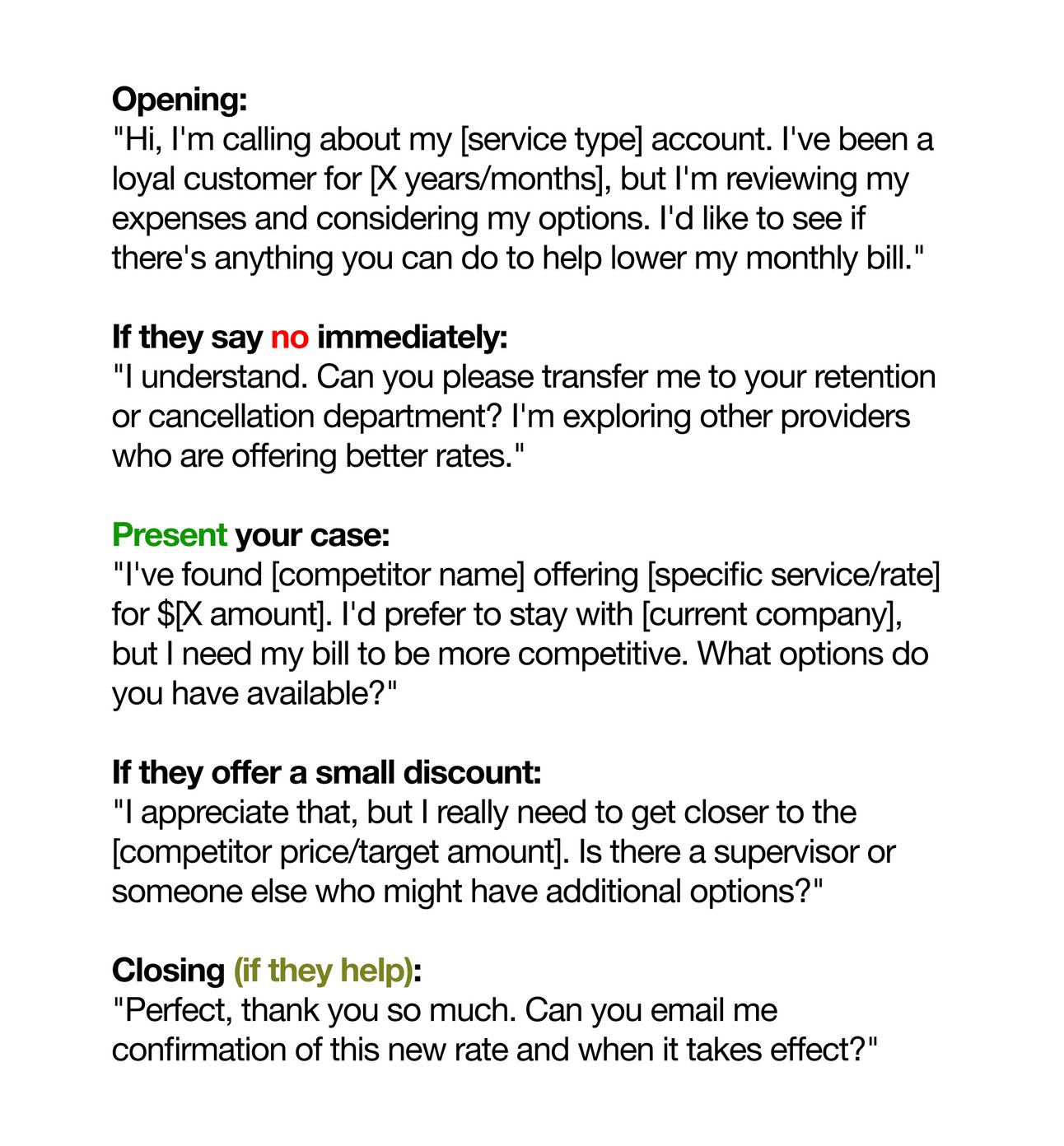

🗣️ What to Say When Negotiating

Okay, now you know what to negotiate—but what about how?

First, let’s look at who you’ll be talking to during these negotiations.

Customer service representatives are often trained to say “no” initially, to see if you’ll stop trying…but, they’re also measured on customer retention metrics. This means they’re often incentivized to keep you as a customer and avoid escalations to supervisors.

They also usually have authority to offer you a coupon. This means your approach with the customer service rep matters tremendously. Aggression backfires, but politeness and persistence works.

👉 Before Getting on the Phone

Spend 10 minutes researching competitor prices. Having specific numbers to reference makes your negotiation stronger.

🕙 Call at the Right Time

It’s better to call mid-week or mid-month. Representatives will be less stressed during these times because they’re not focused on meeting any end-of-month quotas.

📃 Use This Script (and try to read it naturally)

You don’t need to read this verbatim. But here’s a formula to follow:

✍️ Get it in Writing

If the deal you negotiate isn’t immediately applied to your account, ask for email confirmation of the change being made. Make sure it includes exactly when the change will take effect, and how long it will last for.

Put It Into Practice

1️⃣ This week, pick one bill or subscription to negotiate.

2️⃣ Use the script above to call the provider and ask for a better rate.

3️⃣ Then come back to this email, hit reply, and tell me how much you saved (I’m genuinely curious).

💵 Budget Breakdown: Splitting Your Bills With Your Partner

Today we’re breaking down a topic from Brenda on TikTok. Here’s how she and her boyfriend split their bills between each other:

Here’s the gist:

Brenda makes more money than her boyfriend.

They make around $3,000 per week combined.

The house they live in is owned by Brenda, and her boyfriend does not own any part of the home.

Brenda | Boyfriend |

|---|---|

Her car payment | Mortgage |

Her car insurance | Home Insurance |

Her life insurance | Water |

Her music apps | Electricity |

$2k/month for mortgage surplus payments | Groceries |

Her and her boyfriend’s savings | Gas for his car |

His music apps |

Brenda explains why they decided on this setup:

If her boyfriend had an equal amount of his paycheck leftover, he wouldn’t be able to manage it as effectively.

They decided on treating Brenda’s income as if it “didn’t count,” and using it for the extra mortgage payments and savings. She said they each focus on their strengths, and managing money is not one of her boyfriend’s strengths.

Well then.

Here are my thoughts:

Brenda owns the house, which means she is accruing equity and benefits from owning an appreciating asset 👀.

It’s risky for Brenda’s boyfriend to have someone else in control of his savings. I would almost never recommend this 🙅.

If Brenda and her boyfriend were to split up, how would he get his share of the savings? 🤔

In this case, splitting costs 50/50 would likely be easier and more straightforward for them both. Let me know what you think below.

What would you do? |

🔗 Quick Links

💳 Capital One recently acquired Discover.

🧖🏻♀️ Avoid this financial mistake everyone makes.

😱 Are you afraid of running out of 💸 money? Read this.

P.S. — Are you on X? If so, follow me on X/Twitter to catch my daily thoughts on personal finance and engage directly with me.

A primary home isn’t an investment.

Proof:

(If you subtract the sunk costs from the home value, you’re only around $300k net positive after 30 years.)

— Lee Schmidt (@leeschmidt123)

3:01 PM • Jun 4, 2025

What'd you think of this issue? |