- Beyond the Balance

- Posts

- How to Spend While You’re in Debt

How to Spend While You’re in Debt

Don’t cut all the fun spending

Hey — it’s Lee from Refresh.me.

“If you have debt, the only time you should see the inside of a restaurant is if you work there.”

Hm.

I understand the sentiment here: It’s financially irresponsible to spend excess money on non-essentials when you have high-interest debt.

But if taken to an extreme, this black-and-white thinking can be counterproductive. It’s more important to understand the true cost of your choices, rather than eliminating every small pleasure.

In today’s issue:

How to spend when you’re in debt

Budget Breakdown: Getting your hair done with $99k in credit card debt

How to get a monthly credit report

🔍 Deep Dive: How to Spend While You’re In Debt

Don’t get me wrong, high-interest debt like credit cards is problematic. With interest rates around 20-25%, your balance grows fast.

Imagine a $5,000 vacation, and you put it on a credit card. Then you realize you’re in for 23 years of minimum payments and thousands of dollars in interest alone.

This is why aggressive payoff strategies make sense.

But these conversations often stop at “pay it off as fast as possible” without considering what that actually means for real people living real lives.

Does All or Nothing Debt Payoff Make Sense?

Financial advice often tends to target small expenses, because the math feels actionable: Skip your daily $5 coffee and save $1,825 per year!

Cool. That’s easy to measure. Easy to add up. Easy to implement.

But here’s what you should consider:

There’s a sacrifice that comes with limiting these small expenses. And they aren’t always immediately obvious.

Here’s a few examples:

Scenario 1: The Ramen Diet

Sarah has $8,000 in credit card debt and decides to eat only ramen, soup, and other cheap foods to maximize debt payments. She saves around $150/month on groceries, but doesn’t feel great.

Her body isn’t nourished well, so Sarah ends up:

Feeling fatigued at work

Going to the doctor more

Paying for convenience in other areas because she’s tired and feels deprived

Sure, saving $150/month helps Sarah get out of debt faster. But is it worth sacrificing her health?

Scenario 2: The Coffee Shop Office

Mark has $12,000 in debt. He works remotely and has a few dogs. Working at coffee shops makes him more productive because he isn’t distracted by the dogs at home.

He spends around $120/month on coffee while working, but this habit provides:

An environment that increases his productivity at work

Social interaction that helps his mental health

Separation between work and home that improves his focus

The mathematically “optimal” decision would be eliminating his coffee spending, but the real-world result might actually harm his finances.

Consider the True Costs

Sure, in both scenarios cutting the small expenses would help Sarah and Mark get out of debt faster. But both have serious downsides.

Your physical and mental health aren’t just personal values, they have economic impact.

Before getting extreme and cutting all your non-essentials, consider these 3 costs:

Physical Health Costs: Is cutting the cost putting your health on the line? Are there potential long-term health impacts?

Mental Health Costs: Is cutting the cost leading to social isolation? What do you need for your mental health to be sound?

Opportunity Costs: Is it preventing you from a possible gain in another area? (e.g., Work performance declines because of poor self-care, missing a networking opportunity by not paying for the ticket, etc.)

Informed Awareness > Blind Deprivation

Cutting back discretionary spending is valuable when you have debt. But not if it’s done without intention.

Conscious, informed spending beats unconscious deprivation any day.

Low Awareness, Unconscious Spending | Medium Awareness, Default to Restriction | High Awareness, Informed Spending |

I have some credit card debt but I’m not sure how much or what the interest rate is. | I have credit card debt so I can’t spend money on anything unnecessary. | I have $10,000 in credit card debt at 23% interest. |

The question isn’t whether you should spend less while in debt. It’s essential if you want to get out of debt faster.

But an all-or-nothing approach isn’t necessary to do this. Focus on making rational decisions about what’s worth the cost (the extra interest you’ll pay by not putting the money toward debt).

Here’s what I think is generally worth it and not worth it:

Generally Worth the Interest Cost | Generally Not Worth the Interest Cost |

|---|---|

Nutritious food that keeps you healthy and energized | Subscriptions you don’t actively use |

Transportation that gets you to and from work (allows you to make money) | Luxury purchases for status (like nice cars you don’t need) |

Basic housing in a safe area | Lifestyle inflation beyond basic comfort (Is the luxury high-rise needed right now?) |

Healthcare and preventative care | Impulse purchases |

Spending that supports your earning potential | Entertainment that puts a strain on your budget |

One-Time Big Expenses Over Frequent, Small Ones

The small expenses are important. But they often aren’t the silent killer. It’s the large purchases you didn’t think through enough.

Here are a few examples:

The $30,000 wedding that lasted a few hours

Buying a $50,000 car that was out of budget

Signing a lease on an apartment that makes your budget tight

Not considering insurance costs on the home you bought

Author Ramit Sethi emphasizes this in his book I Will Teach You to Be Rich: The wealthy focus on the $30,000 questions over the $3 questions.

This isn’t to say you shouldn’t focus on the small expenses. But you should be even more aware and informed before making the big decisions.

Practical Guidelines for Spending While in Debt

1️⃣ Know Your Numbers

Before making any spending decisions, understand:

Total debt amount

Interest rates for each debt

Minimum payments required

Timeline for payoff at current rate

2️⃣ Calculate the True Costs

For non-essential expenses, think through the total cost including interest. For example, a $100 dinner isn’t just $100—it’s $100 plus the amount you’re paying in interest by not using the money for debt.

Is the expense worth it? If it is, don’t guilt yourself over spending on it. And if it isn’t, keep the funds for debt payoff.

3️⃣ Protect Your Health and Earning Capacity

Keep (reasonable) expenses that maintain your ability to earn income and stay healthy.

For example, don’t cancel the $40/month gym membership if working out is “your form of therapy.” Don’t opt for the unreliable train over taking your car to work to save a few bucks on gas if it means possibly being late to work.

4️⃣ Set Conscious Limits

Instead of eliminating categories completely, set specific budgets for discretionary spending. It’s okay to have a reasonable coffee budget while in debt. This maintains a solid quality of life while still prioritizing debt pay off.

💡 Put It Into Practice

If you have debt:

1️⃣ Take an inventory of your debt balances, interest rates, required monthly minimum payments, and timeline for payoff.

Here’s a great calculator to help with this.

2️⃣ Look at your budget. If you don’t have one, just grab a copy of your bank and credit card statement and see where you’re spending.

3️⃣ Evaluate which expenses are worth it. Make a plan to cancel or reduce the ones that aren’t.

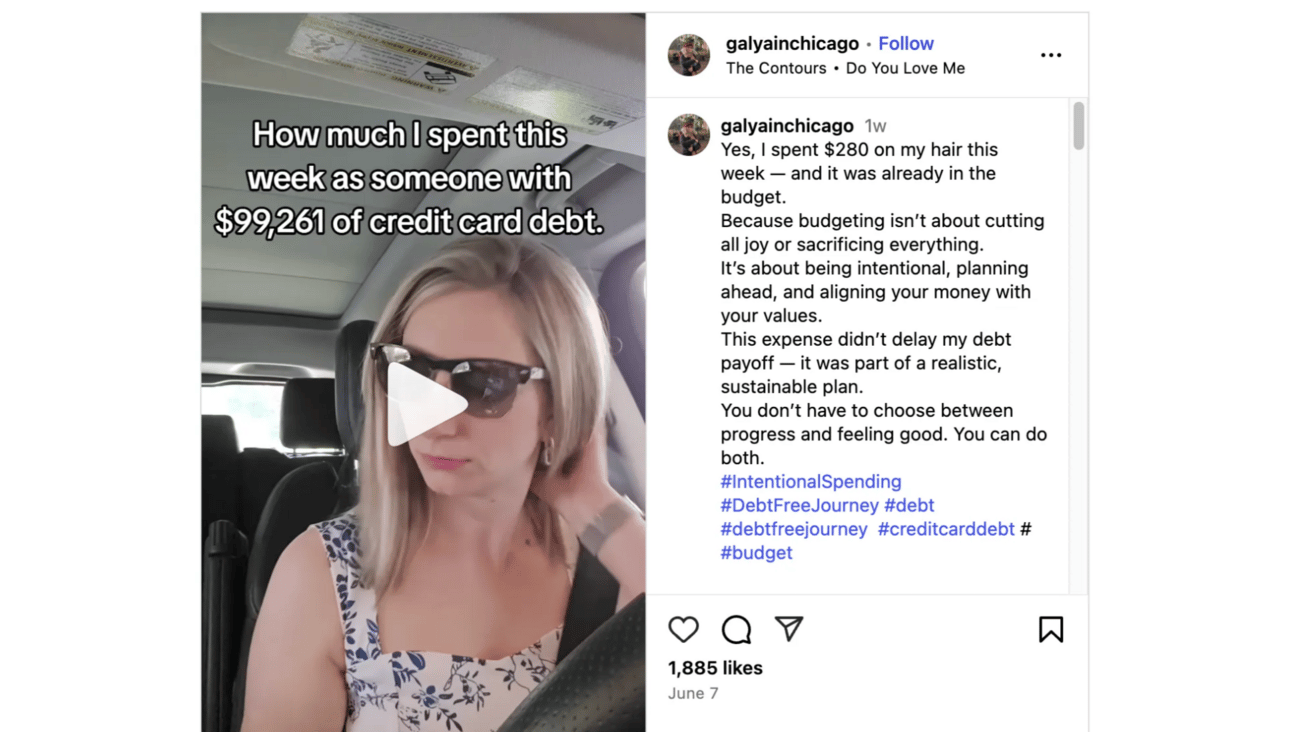

💵 Budget Breakdown: Self Care While in Credit Card Debt

An Instagram user named Gayla shared this video explaining why she spent $280 on getting her hair done despite being in $99,000 of credit card debt.

The caption explains her position:

She budgeted for getting her hair done.

She isn’t cutting all joy or sacrificing everything.

Spending on expenses like this is part of her overall realistic, sustainable debt payoff plan.

The video sparked quite a conversation in the comments, with viewers saying things like:

So you can no longer afford to be blonde. Hope this helps!

This is bad financial advice…if you’re in almost six figures of debt with high interest rate…stop the consumerism and plan to live below your budget.

Girl please get a financial counselor and quit posting on Instagram.

Here are my thoughts:

I respect her for sharing this so transparently. Clearly, based on the comments, it’s not easy to put this information out there, but I do think it’ll help other people.

This video is one glimpse into her spending. $280 for hair services is standard in a city like Chicago (where she lives), and she said in a comment she gets her hair done twice per year.

Is it non-essential? Yes. But I don’t think we can judge whether it’s reasonable without understanding her other spending.

Based on her other videos, it seems like she’s actively putting a decent amount onto her debt and this is one of the few non-essential spends she indulges in to maintain balance.

What would you do? |

🔗 Quick Links

💳 Get a monthly credit report to stay on top of your score.

😅 Unhinged things people do to save money.

💰 Quick ways to save money on your electric bill.

P.S. — Are you on X? If so, follow me on X/Twitter to catch my daily thoughts on personal finance and engage directly with me.

College degrees are expensive participation trophies.

Why are kids in class just for a professor to read straight out of a $50 textbook from Amazon?

Employers care less about credentials and more about skills anyways. Yet 18-year-olds are still signing up for $150k of debt

— Lee Schmidt (@leeschmidt123)

2:58 PM • Jun 13, 2025

What'd you think of this issue? |