- Beyond the Balance

- Posts

- Is Your Car Killing Your Budget?

Is Your Car Killing Your Budget?

What to think about before buying a car

Hey — it’s Lee from Refresh.me.

I read an article this week which said the average car payment in the US has reached $742 per month.

That’s $742 per month…towards a depreciating asset.

Sometimes you don’t have much of a choice when purchasing a car. You might only have few loan options you qualify for, so you end up with a payment that’s larger than you’d like.

But if you do have a choice, and you’re smart about it—there are several factors you should consider before splurging on a car. Let’s talk about it ⬇️

In today’s issue:

What to consider before purchasing a car

Budget Breakdown: The cost of a wedding

How to find unclaimed money

🔍 Deep Dive: Car Payments Can Sabotage Your Finances

Just because you’re approved for a loan doesn’t mean you can afford it.

This is one of the most dangerous traps you’ll encounter when purchasing a car.

Lenders have become increasingly aggressive with auto loans, approving more people than they responsibly should.

For example, auto lenders are:

Approving recent college graduates for $50k cars

Extending loan terms up to 84 months

Offering minimal down payment options

While this makes purchasing a vehicle more “accessible,” it’s setting a lot of people up for total financial failure. These loans are often way more than people can actually afford.

🧾 The Real Cost of That $742 Payment

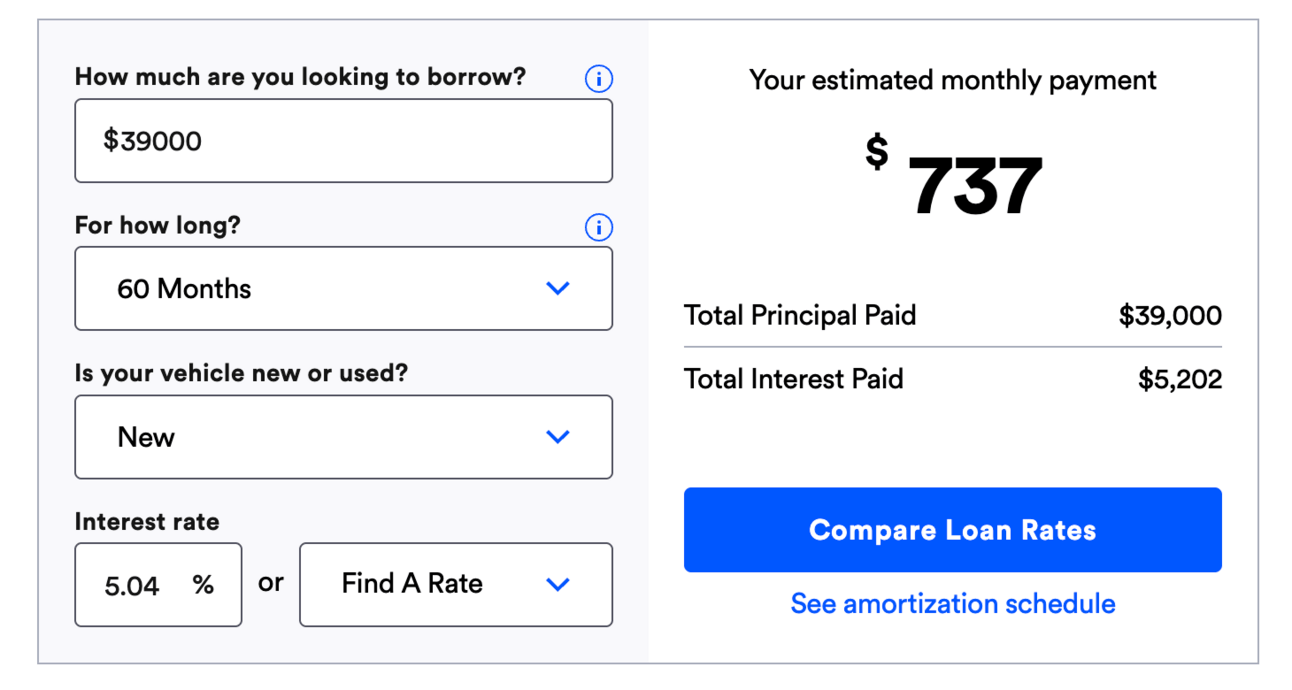

A $742 monthly car payment might not look too bad, but let’s take a look at the details:

If we use the average interest rate and loan length, we’re looking at a $39,000 car loan.

At the end of the loan term you’re paying $44,202 total for an item that’s significantly decreased in value over its lifetime. Is it worth it?

👀 The Opportunity Costs

I’m not saying financing a car is a bad idea. You need transportation, and if you have to commute to work or shuttle kids around, a car obviously makes sense—and sometimes financing makes sense too.

But you need to consider the overall cost of the car you’re buying and what you’re giving up by spending additional money on a car.

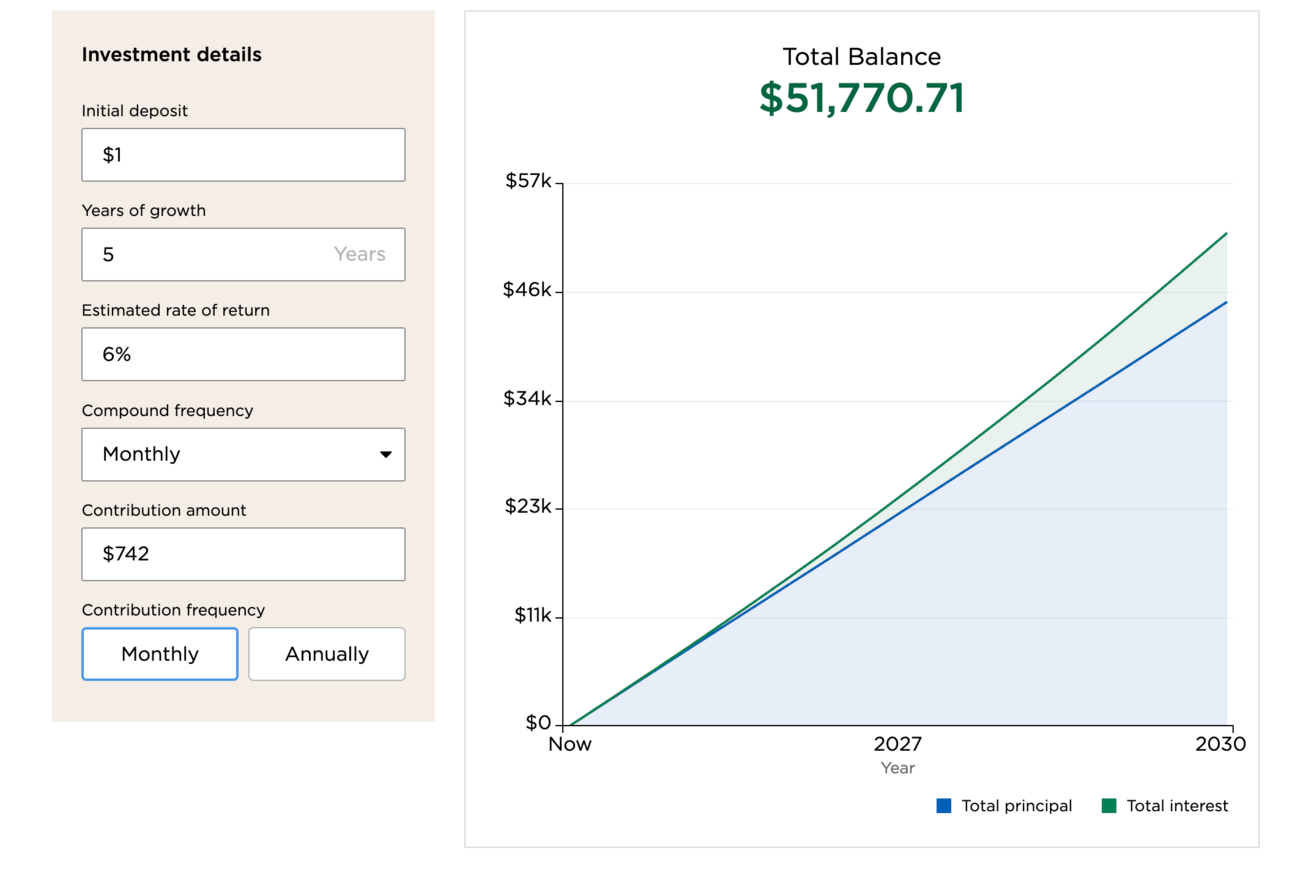

📈 Investment Earnings

For example: If you invested $742 per month for 60 months (5 years), you’d net roughly $7,200 in returns (assuming a very modest 6% rate of return).

Let that $51,770 sit for….another 35 years? Now you could end up with $420,556 (again assuming a very conservative 6% rate of return). This is without contributing another dollar.

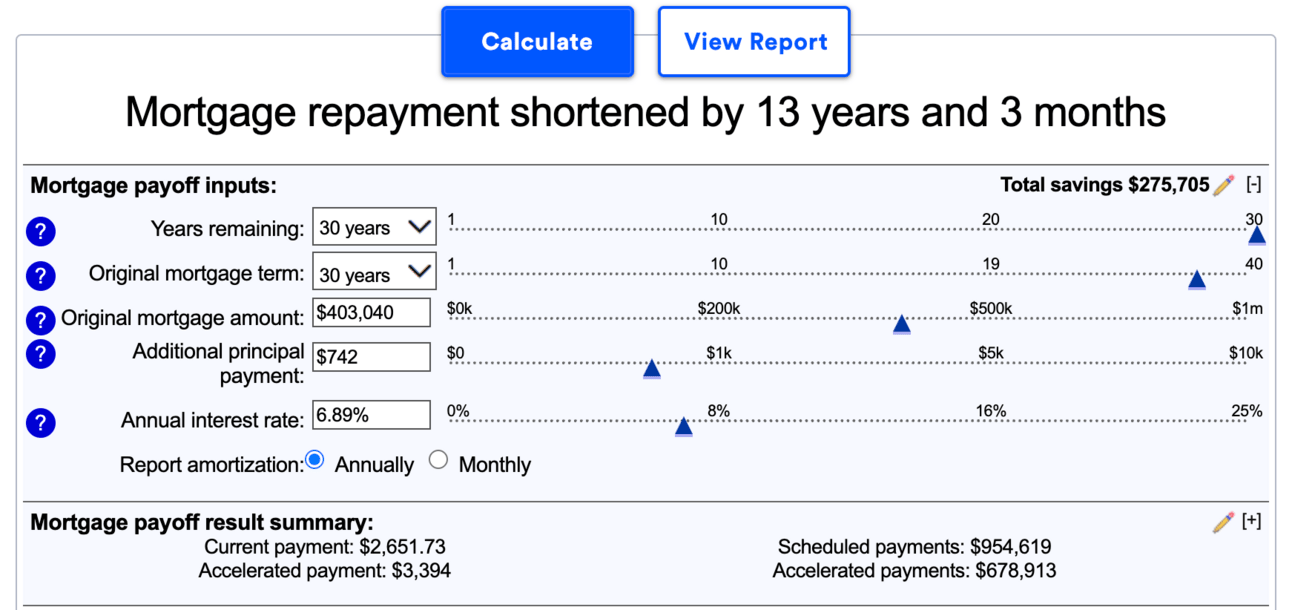

🏠 Home Mortgage Savings

If you have a mortgage, you could save a ton of money by using that car payment to pay off your home.

The average interest rate on a 30-year fixed-rate mortgage is 6.89%.

The average home price is $503,800.

Assuming a 20% down payment, here’s what a $742 per month surplus payment could save you on your home loan:

Those extra payments would save you a whopping $275,705! 🤯

💵 Savings on High Interest Debt

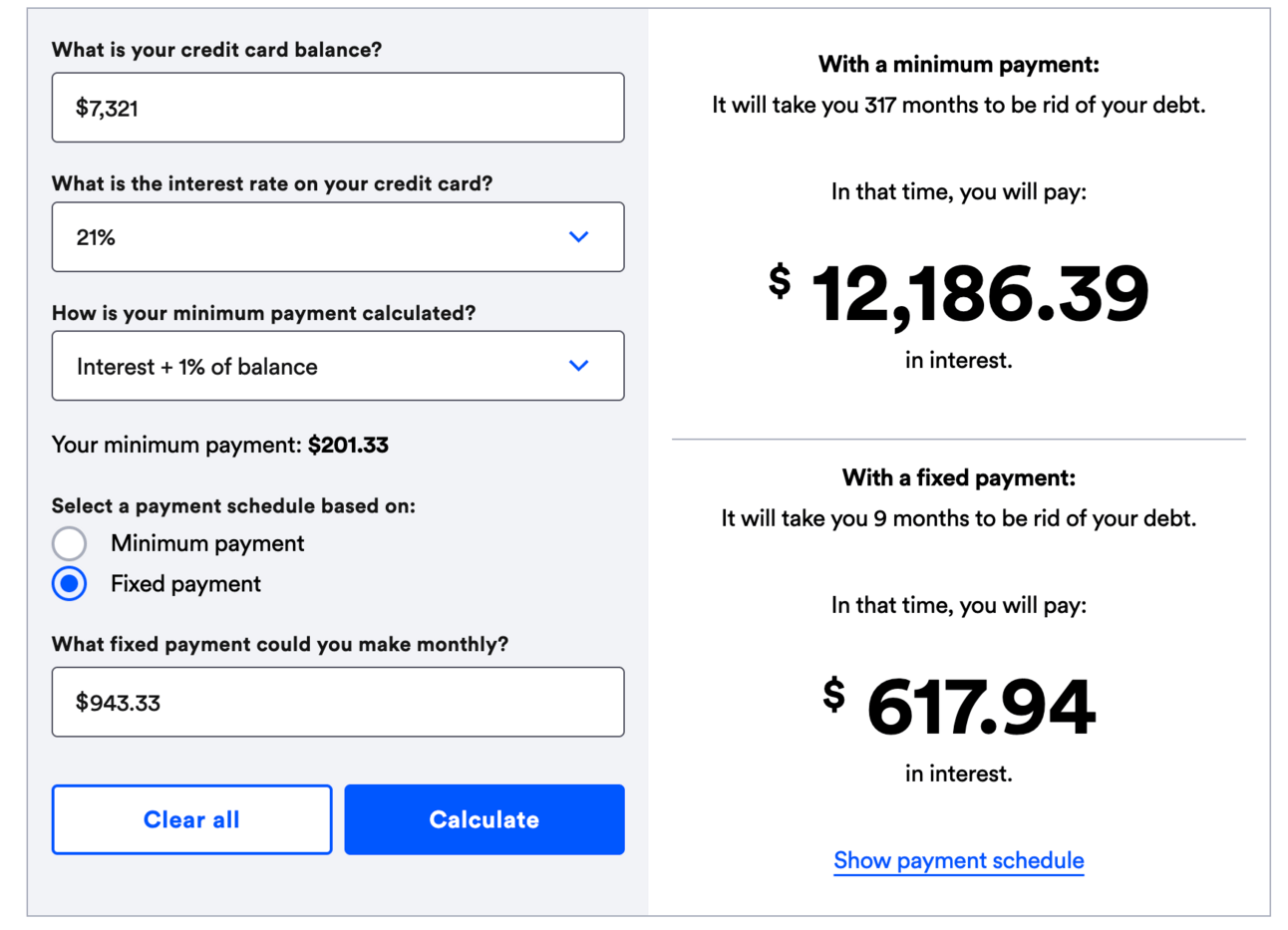

In Q1 2025, the average credit card debt balance was $7,321.

It would take 317 months (26 years) to pay off this debt if you made only the minimum payment.

If you instead allocated $742 per month toward this debt, you could be credit card debt free in only 9 months! This saves you over $11,000 in interest.

👉 Finding the Middle Ground

Don’t get me wrong—spending money on a car payment isn’t a total waste. But you should think long and hard about the purchase, and don’t buy something more than you can responsibly afford.

Ideally, keep your total transportation costs (payment, insurance, fuel, maintenance) under 15% of your gross income.

This means that to justify the average $742 per month car payment, you’d need an income of around $60,000.

The financially optimal decision is often a 2-3 year old vehicle. Here’s why:

Avoids Depreciation Cliff: New cars lose 20-30% of their value in the first year alone. By purchasing slightly used, someone else absorbs that depreciation hit (not you).

Reliability Without the Premium: Modern vehicles are remarkably reliable. A 2-3 year old car with 20,000 miles on it typically has years of trouble free driving in its future. And it costs significantly less than buying new.

Better Selection: The 2-3 year age range is often the sweet spot for finding certified pre-owned or used cars with low mileage. Many manufacturers also offer extended warranties for vehicles of this age.

🧠 A Few Reminders

Just because you qualify for a loan doesn’t mean you can afford it.

Run the numbers in your budget before signing on the dotted line. What would the payment do to your budget? Do you still have enough to save, invest, and spend?

Consider buying a used car, because it can save you a ton of money.

💡 Put It Into Practice

If you’re in the market for a new car, run the numbers on your car payment versus your budget. If you already own a car, consider making an extra payment on the principal balance to get that car paid off faster.

💵 Budget Breakdown: Cost of a Wedding

This is Taylor from TikTok. She recently broke down how much her 2026 wedding is going to cost, and I have some thoughts. I also want to know what you think.

Here are the costs she shared:

Expense | Cost |

Venue (175 people) | $34,000 |

Decor Team | $3,500 |

Decor Team | $2,300 |

Photographer | $5,500 |

Videographer | $3,800 |

Violin Quartet for the Ceremony | $1,600 |

DJ for the Reception | $2,500 |

Transportation | $6,400 |

Hair & Makeup | $3,050 |

Hotel for Getting Ready | $1,600 |

Total | $64,250 |

A couple other notes:

She didn’t include small things like invitations (which she DIY’d) and other DIY decor she made.

She and her fiancé are paying for most of it out of pocket, but she did share they have help from family as well.

Here are my thoughts:

I appreciate the radical transparency. It’s helpful for people to see the reality behind the weddings they see on social media.

Forbes estimates that the average cost of a 150-200 person wedding is $41k. Taylor isn’t too far off from that.

A wedding is an important day, but for just one day, $64k seems a little much (unless you have the cash to spare).

I’d keep things like the photographer and videographer, but I’d reconsider expenses like the transportation—could guests just grab an Uber?

What would you do? |

🔗 Quick Links

💳 How to see if you have unclaimed money.

🏠 When will mortgage rates go down?

💰 How to make more money without working more.

P.S. — Are you on X? If so, follow me on X/Twitter to catch my daily thoughts on personal finance and engage directly with me.

College degrees are expensive participation trophies.

Why are kids in class just for a professor to read straight out of a $50 textbook from Amazon?

Employers care less about credentials and more about skills anyways. Yet 18-year-olds are still signing up for $150k of debt

— Lee Schmidt (@leeschmidt123)

2:58 PM • Jun 13, 2025

What'd you think of this issue? |