- Beyond the Balance

- Posts

- Why Small Money Decisions Matter More Than You Think

Why Small Money Decisions Matter More Than You Think

These small but frequent decisions can silently make or break your wealth

Hey — it’s Lee from Refresh.me.

I've been thinking about a question someone asked me last week: "Why do I feel like I'm doing everything right with money, but I'm still not getting ahead?"

The answer hit me: they were focused on the big decisions like career moves, the major purchases, the once-a-year budget review. But wealth isn't built in those moments. It's built in the thousand tiny decisions you make every single week that you're not even paying attention to.

That $12 lunch. That subscription you forgot about. That "it's on sale" purchase. These feel insignificant in the moment, but they're not. They're patterns. And patterns compound, for better or worse.

Today, we're going to look at the invisible architecture of wealth: how the smallest financial decisions you make are either building your future or quietly dismantling it.

In today’s issue:

🔍 Why Small Money Decisions Matter More Than You Think

💸 Budget Breakdown: Sarah the millionaire budgeting on $50k / year

🎄 How to avoid overspending for the holidays

🔍 Deep Dive: Why Small Money Decisions Matter More Than You Think

You're standing in line at your favorite lunch spot, about to spend $12 on a sandwich and drink. It's just $12. You work hard. You deserve it. And honestly, in the grand scheme of your financial life, what's $12?

Except it's not just $12.

That $12 represents a pattern. And that pattern represents a choice about the life you're building. This isn't about the sandwich, it's about understanding the invisible architecture of wealth that most people never see.

Here's what I mean.

🔄 The Invisible Cost of Patterns

Most people think about money in snapshots: "Can I afford this right now?" But wealth-builders think in patterns: "What does this decision look like when I make it 100 times?"

That shift in perspective changes everything.

Let's trace that $12 lunch through time. If you buy lunch every workday:

This week: $60

This month: $240

This year: $3,120

Over 5 years: $15,600

Over 10 years: $31,200

Now, I'm not here to shame you about buying lunch. But I am here to show you what that pattern actually costs, because most people have never done this math. They see $12. They don't see $31,200.

And here's where it gets really interesting: if you took that same $3,120 per year and invested it at a conservative 7% annual return, you wouldn't have $31,200 in 10 years. You'd have $43,000. In 20 years? $127,000.

One lunch pattern. Six figures.

But let's look at other patterns you might not be tracking.

📺 The Subscription Creep Pattern

You sign up for a streaming service. Then a meditation app. Then a meal kit delivery you use twice a month. Then a premium music service. Then cloud storage. Then a fitness app.

Each one feels small:

🍿 Streaming: $15/month

🧘♀️ Meditation app: $10/month

🥗 Meal kit: $60/month (you tell yourself you'll use it more)

🎶 Music: $11/month

☁️ Cloud storage: $10/month

🏋️♀️ Fitness app: $13/month

Total: $119/month 😬

You barely notice them because they auto-draft. But let's trace this pattern:

This year: $1,428

Over 5 years: $7,140

Over 10 years: $14,280

And that's assuming you never add more subscriptions (you will) and prices never increase (they will).

If you audited these and cut just half, only keeping only what you truly use and value, you'd save $714 per year. Invested at 7%, that's $9,900 in 10 years and $29,300 in 20 years. 📈

From subscriptions you barely remember signing up for.

🏷️ The "It's On Sale" Pattern

This one's sneaky because it feels like you're being financially responsible. You saved 40%! You got a deal!

Except you bought something you weren't planning to buy. You spent money you weren't planning to spend. And "saving" 40% on something you didn't need is actually a 100% loss.

Let's say you make three "great deal" purchases per month at an average of $30 each:

This month: $90

This year: $1,080

Over 5 years: $5,400

Over 10 years: $10,800

If you eliminated just this pattern of buying things because they're on sale rather than because you need them, and invested that $1,080 annually, you'd have $15,000 in 10 years and $44,000 in 20 years.

You didn't save money on those sales. You spent your future.

💳 The Interest Rate Ignorance Pattern

This is the most expensive pattern of all, and most people don't even realize they're in it.

Let's say you're carrying $5,000 on a credit card at 24% APR, making minimum payments of $150/month. Here's what that pattern costs you:

Time to pay off: 4.5 years

Total interest paid: $3,100

Total cost: $8,100 for a $5,000 balance 😱

Now let's say you did a balance transfer to a 0% APR card for 18 months (most have a 3% fee, so $150 upfront) and paid $280/month instead:

Time to pay off: 18 months

Total interest paid: $0 (after the transfer fee)

Total cost: $5,150

You just saved $2,950 by understanding one pattern and making one strategic move. ✅

If you invested that $2,950 at 7%, it would grow to $5,800 in 10 years. That's nearly $6,000 you earned by paying attention to interest rates for one afternoon.

🌟 The Flip Side: Small Patterns That Build Wealth

Here's the beautiful part: if small negative patterns compound into big losses, then small positive patterns compound into massive wins.

Let's run the same math in reverse.

Pattern 1: Pack lunch 3 days a week instead of 5 🥗

Savings: $1,872/year

Invested at 7% over 10 years: $25,800

Over 20 years: $76,500

You still get to buy lunch twice a week. You're not depriving yourself. You're just being intentional about the pattern.

Pattern 2: Redirect one $50 impulse purchase per month 🛒

Maybe it's the thing you almost bought online at midnight. Maybe it's the Target run that turned into $50 more than you planned. Just one per month.

Savings: $600/year

Invested at 7% over 10 years: $8,300

Over 20 years: $24,600

Pattern 3: Negotiate one bill down by $20/month 📞

Your internet. Your phone. Your insurance. Pick one and spend 20 minutes negotiating or shopping around.

Savings: $240/year

Invested at 7% over 10 years: $3,300

Over 20 years: $9,800

Pattern 4: Automate $100/month to investments before you see it 🤖

This is the most powerful pattern of all because it removes willpower from the equation.

Amount: $1,200/year

Invested at 7% over 10 years: $16,600

Over 20 years: $49,200

🧮 Add Them Up

If you implemented just these four small positive patterns:

10-year total: $53,900 🎯

20-year total: $160,100 🏆

You didn't get a massive raise. You didn't inherit money. You didn't win the lottery. You just replaced four expensive patterns with four wealth-building ones.

That's the invisible architecture of wealth.

💭 The Real Question

Every financial decision you make is a vote for the life you're building. Not just the big decisions, but the small ones too. Especially the small ones, because you make those every single day.

So here's the $10,000 question (or really, the $160,000 question): What are you voting for? 🗳️

You're not broke because of one bad decision. You're stuck because of patterns you haven't examined. And the empowering truth is this: you don't need to overhaul your entire life. You don't need to live like a monk or give up everything you enjoy.

You just need to identify your top 2-3 expensive patterns and replace them with wealth-building ones.

Look at your bank statement from last month. Find the patterns. The recurring charges. The category that's always higher than you expect. The "small" purchases that show up 10, 15, 20 times.

Those patterns are either building your future or quietly dismantling it. 🏗️

Which patterns are you going to change this week?

Reply and let me know! 💬

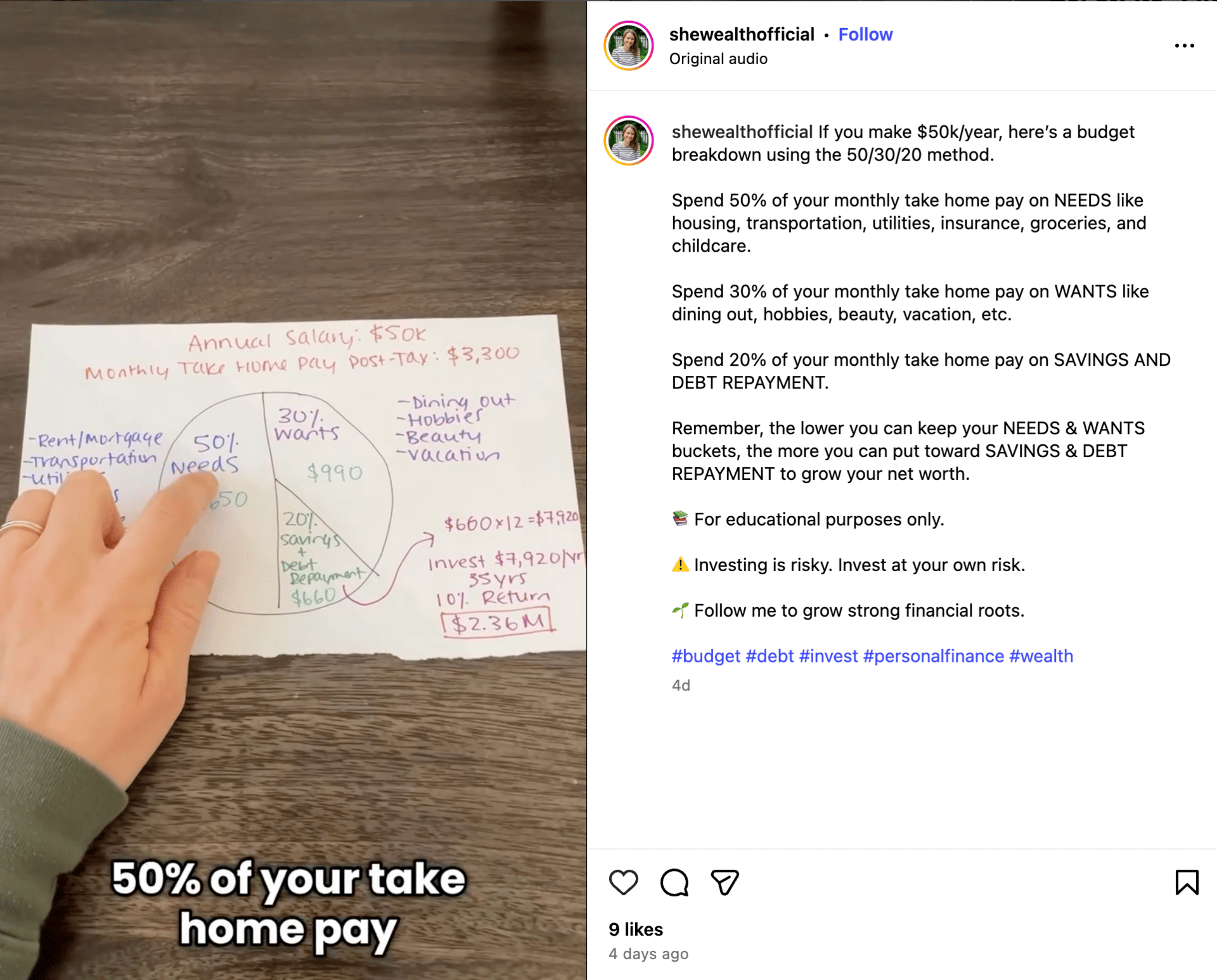

💵 Budget Breakdown: Living on $50k per year

This week's feature is from Sarah, a millionaire on Instagram. But today she’s talking about how to budget on the classic American salary: $50,000 a year. 💸

Not flashy. Not poverty. Just...middle America trying to figure out where the heck all the money goes.

After taxes (assuming you're in a state with income tax), that $50K nets you about $3,300 per month. And here's where it should actually go using the 50/30/20 rule:

💰 50% to Needs: $1,650

🏠 Rent or mortgage

🚗 Transportation (car payment, insurance, gas)

⚡️ Utilities (phone, internet, water, electric)

🛒 Groceries

👶 Childcare

That's it. The boring stuff that keeps you alive and employed.

✨ 30% to Wants: $990

Dining out

Hobbies

Beauty treatments

Vacation fund

Whatever makes life worth living

This is your "I work hard, I deserve nice things" bucket.

📈 20% to Savings + Debt: $660

And here's where it gets interesting...

If you have high-interest debt (>7%): Throw the full $660 at the principal every month. Kill it fast.

If you have low-interest debt (<7%): Split it. Half to debt, half to investing.

If you're debt-free: Invest the whole thing.

Now here's the plot twist that'll blow your mind:

$660/month invested for 35 years at 10% average return = $2.36 MILLION.

That's right. A person making $50K can retire a multi-millionaire just by consistently investing 20% of their take-home pay.

My Thoughts...

This is the budget breakdown that proves you don't need a six-figure salary to build serious wealth. You just need discipline, time, and the ability to resist lifestyle creep. 🫡

The math is simple. The execution? That's the hard part.

Most people earning $50K think "I'll start investing when I make more." But the ones making $100K say the same thing. And the ones making $200K are too busy upgrading their lifestyle to actually save.

The secret isn't in the salary. It's in the gap between what you earn and what you spend.

💡The real question: Are you living like you make $50K while earning $75K? Because that's how you win.

What's your biggest challenge at $50k / year? |

🔗 Quick Links

😱 The biggest retirement mistake you can make

💪 These two money decisions can nail retirement success

🎄 How to avoid overspending for the holidays

P.S. — Are you on X? If so, follow me on X/Twitter to catch my daily thoughts on personal finance and engage directly with me.

What'd you think of this issue? |